Consulting recruiting: office selection considerations

An overview of the office selection process for consulting firms and what best practices to employ to select the right office.

|

|

|

Staffing models | Regional considerations | Matching process & strategy

Consulting firms are unlike typical corporations in many ways – and one of the most obvious is their decentralized geographic footprint. Where a large corporation, like Apple or Target, may corral together 10,000 or more employees in a giant corporate headquarters, consulting firms tend to have many more offices, with fewer employees housed in each. For example, McKinsey has more than 130 offices in more than 65 nations worldwide – yet its largest office, in New York, employs fewer than 1,000 consultants.

Another obvious difference is the extent of travel involved in consulting. However diffuse a firm’s office network is, each week that firm will send out hordes of consultants, traversing the globe to even more far-flung client sites.

These two factors dovetail when it comes to thinking about which consulting offices you might like to apply to and subsequently work in. Travel is inherent in consulting (though we may be at an inflection point, given COVID-19 – more on this below), but staffing models vary across firms, and home office choice has wide-ranging implications on both the work you’ll do and the manner in which you’ll do it.

Staffing models & team structure (Top)

The nature of travel you may encounter as a consultant varies from firm to firm and client to client.

The traditional, legacy model was to spend four days per week at the client site – out Monday mornings, back Thursday nights – with Fridays spent at your home office. On some projects, however, the only travel might be for periodic client meetings, with the bulk of the work done from your home office. Some firms also allow consultants to work Fridays from home or another location – for example, by taking advantage of a “leveraged fly-out.”

That said, the COVID-19 pandemic may be changing the game. After 18 months of working largely remotely from home, many firms are considering hybrid models with less travel and more technologically-enabled collaboration. Just how permanent these shifts will be remains to be seen.

Today there are two major staffing models:

- Regional staffing: This approach aims to staff projects with consultants from nearby offices. Team members may all come from the same home office, but usually come from offices within the at least the same region and country. The goal of this model is to limit productivity loss to travel time and minimize the impact of travel on lifestyle.

- Global staffing: In this approach, a team may be staffed with consultants from literally any office in the nation or world. Team members typically do not all come from the same home office and so work Fridays remotely from one another. Team members staffed from very a distant home office may not travel home on the weekends, and instead stay in a hotel for the weeks- or months-long duration of the project. The goal of this model is to staff the absolute best fit of consultant to project – from an expertise and interest perspective. Cultural – and sometimes linguistic – immersion are part the package.

Be sure to ask recruiters about the staffing model for any firm you are considering.

Historically, Bain has taken a more regional approach – something that is especially true with their sizable private equity practice. (Since PE due diligence work involves working for a client that is evaluating a third-party prospective acquisition, there is no need to be on the client site full-time – and confidentiality often prevents the consultants from visiting the target site.)

BCG and – especially – McKinsey take a more global approach. My own two years at McKinsey took me to Denmark, Mexico, the United Kingdom, and the Netherlands – as well as a host of domestic destinations spanning from California to New York.

Regional considerations (Top)

Regardless of the staffing model engaged, consulting firms recognize that travel is time-consuming and expensive – and so even in a global staffing system, there is a bias for limiting travel. This means that your home office really will have an impact on the work you do.

There are a variety of factors to consider when weighing potential offices:

- Urban density: High-density urban areas (e.g., the US Northeast) simply have a higher concentration of clients, and thus can create a higher probability of more limited and local travel. More isolated offices on the other hand – think Reykjavik – are more likely to necessitate longer travel to reach client sites.

- Cost of living: Some firms implement nationwide salary-setting, especially at the more junior levels. In other words, although San Francisco may have a cost of living 95% higher than the US average and Austin may have a cost of living 2% lower than the US average, some firms will pay associates in both cities the same amount.

- Work-life balance: While consulting is hard work in any city and at any firm, the local work culture still bleeds over to work-life balance in consulting. In the US, the major metro offices in the Northeast typically work longer hours. Internationally, Germany and Asia similarly have a reputation for poorer work-life balance.

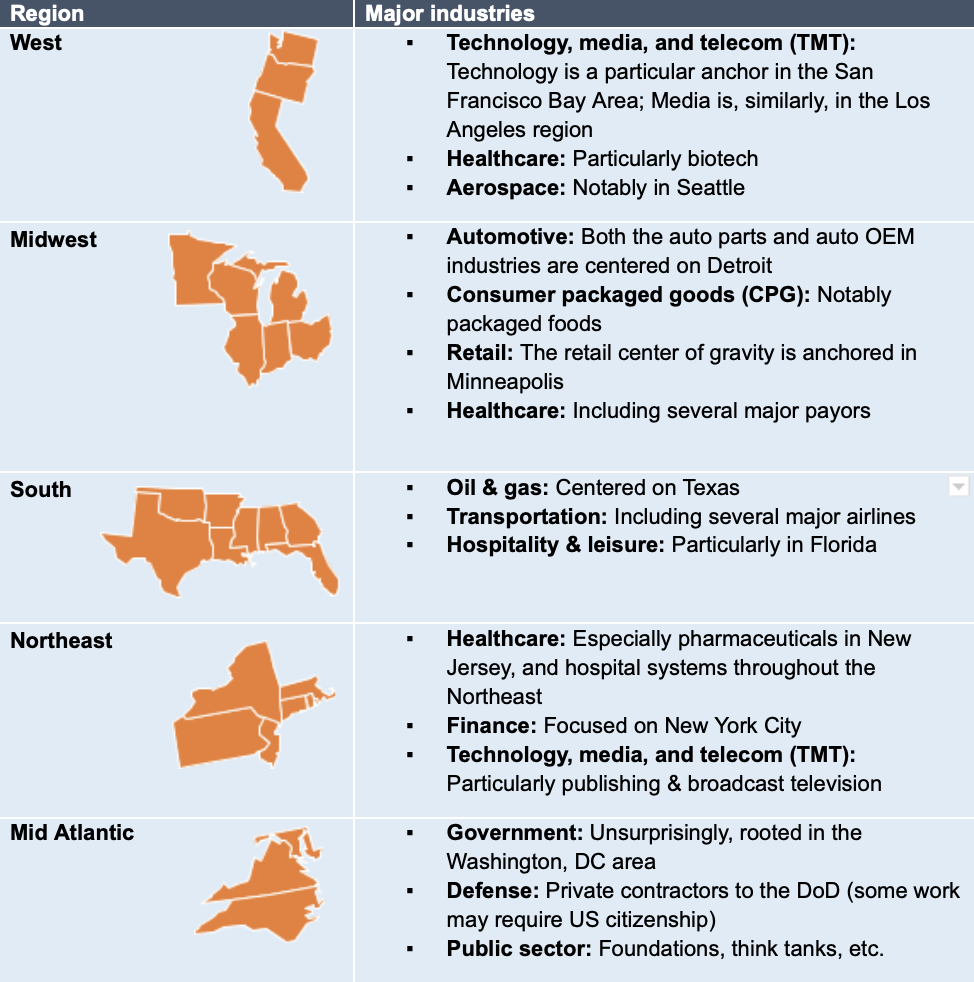

- Regional client footrpint: Given you are more likely to serve clients closer to than further from home, the nature of potential clients in the region matters. Below is a quick primer of the industries you are more likely to see in the major US regions:

💡 Shameless plug: Our consulting interview prep can help build your skills

Office matching process & strategy (Top)

Deciding where you might like to work is only half the battle. The larger firms, with many offices, engage a matching process, not unlike the residency match process for graduating medical students – so the choice isn’t entirely up to you.

Candidates typically force rank as many as their top five office choices upon applying to a firm. The first round of interviews is often office-agnostic, but becomes office-specific after that. The first round may take place at a local office, or may take place on campus for target schools, like Harvard or UC Berkeley. In the second round, offices typically rank candidates back, and pull them out to interview on site. You will only proceed to the final round with one office, and offers are made for a specific office.

If the final round office does not make a candidate an offer, the candidate terminates the interview process with all offices – they do not get a do-over with an office they ranked lower. While consulting firms do have good mobility between offices after a few years, you typically cannot transfer an offer to another office before you start, should your location preferences later change.

When it comes to the winning strategy for office selection, rumors are rife. Some candidates theorize that certain firms or offices have a stronger connection with certain universities, and so rank those offices higher. Other candidates theorize that smaller, less urban offices are less competitive, and try to game the system by ranking those offices. Unfortunately, such rumors are by definition unverified. Certain offices doubtless receive a higher volume of applications, but I’ve never seen any credible numbers to suggest the ratio of offers-to-applicants is reliably higher at one office versus another.

Your guiding strategy should be simple: Pick offices based on where you actually want to live, and then layer the above-listed regional considerations on top of that.

It is important to have a solid story explaining your connection with any given office – for example having family in the area, having gone to school nearby, or being interested in the dominant industry of the region. Offices tend to be wary of seemingly random choices, viewing candidates without clear ties as being more likely to become unhappy with the location and quit, or to be angling for an office transfer from Day 1.

Random choices also can also come across as game playing. While it is true that the larger coastal metropolises tend to house the more selective offices, no partner wants to hire an analyst whose main criterion for selecting their office was that they thought they couldn’t get into New York.

A final consideration may be specialist or functional groups, if the firm you are applying to has them (e.g., a technology vertical). Many companies have recently diversified into such niche verticals, and they may well see fewer applicants than the generalist pool. If you have expertise in a given area, applying to that focus area – or the office where that focus area is based – may be a good option.

Conclusion

I’ll leave you this one parting caveat – although it seems exciting on paper, travel is often more draining and tedious than it is thrilling. With the exception of team dinners and perhaps a biennial retreat, you won’t see much more of your destination than the client site and the inside of a hotel room.

Be sure to evaluate your own appetite for travel honestly, and consider how the firm’s staffing model and the regional realities outlined above will combine to shape your job satisfaction. Office selection is a big decision – so choose carefully, but trust your gut and don’t fall into the trap of trying to play the system.

Read this next:

- Consulting Getting Started Guide

- Full cases from RocketBlocks

- Consulting career path, compensation and responsibilities

- Partner compensation at MBB

- Applying from a non-target school

- Experienced hire recruiting process

- Switching from PhD into consulting

- Consulting internships at MBB

- Consulting re-application

- Consulting exit opportunities

- Associate Consultant salaries

- Consulting cover letter

- Consulting international recruiting

- Consulting resume

- McKinsey consultant salary

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.