Google metrics: key benchmarks for PM interviews

|

|

|

If you're interviewing for product management roles at Google, it's extremely helpful to understand the scale at Google operates and how they've grown over time.

The Google data pack below, which we've pulled together from SEC filings, press releases and public statements from Google (plus our own analysis, will help you get a grip on key Google metrics and evolution. We cover the following:

- Google product launches, from 2000 to 2020

- Google revenue growth, from 2008 to 2020

- Google search queries per day, from 2000 to 2020

- Google users per platform, including Android, Gmail, YouTube, Maps, Photos, Play

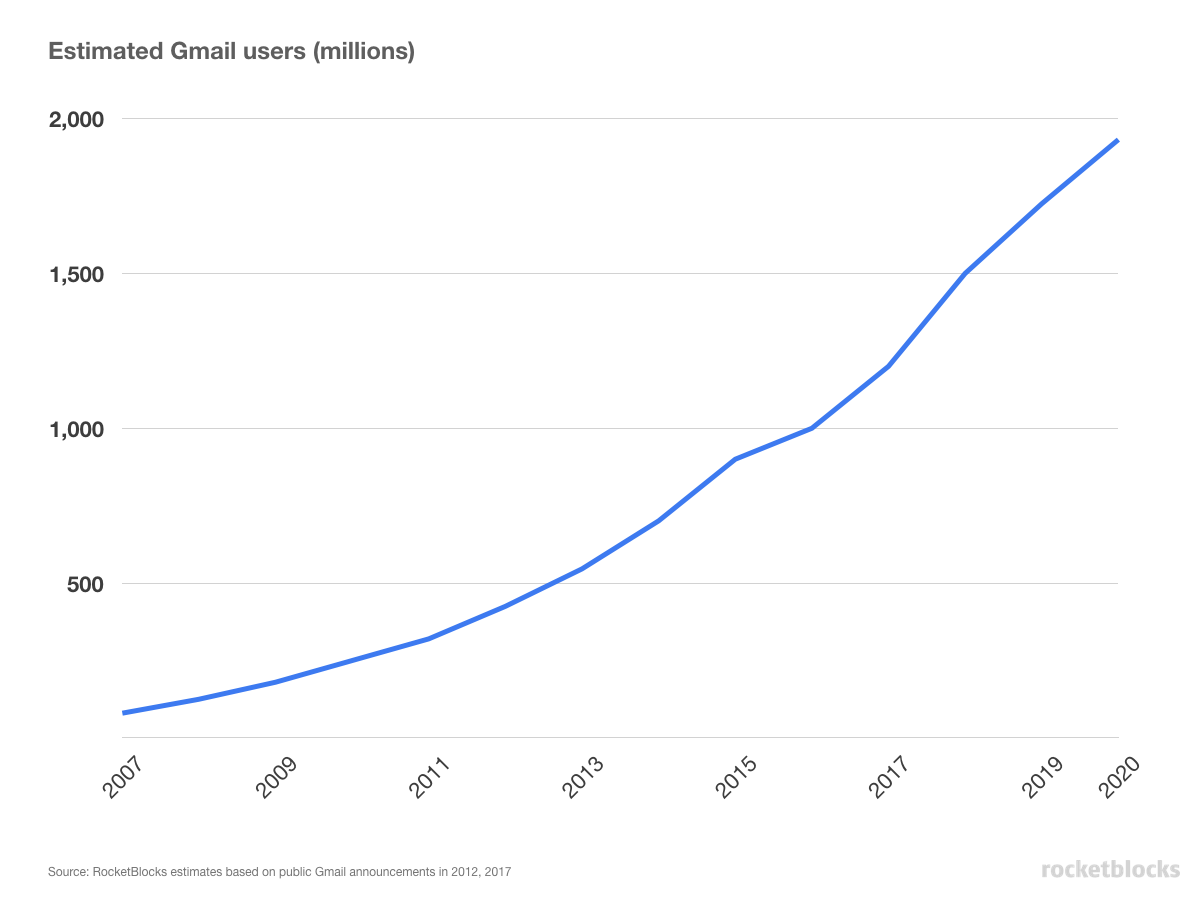

- Gmail user growth, from 2006 to 2020

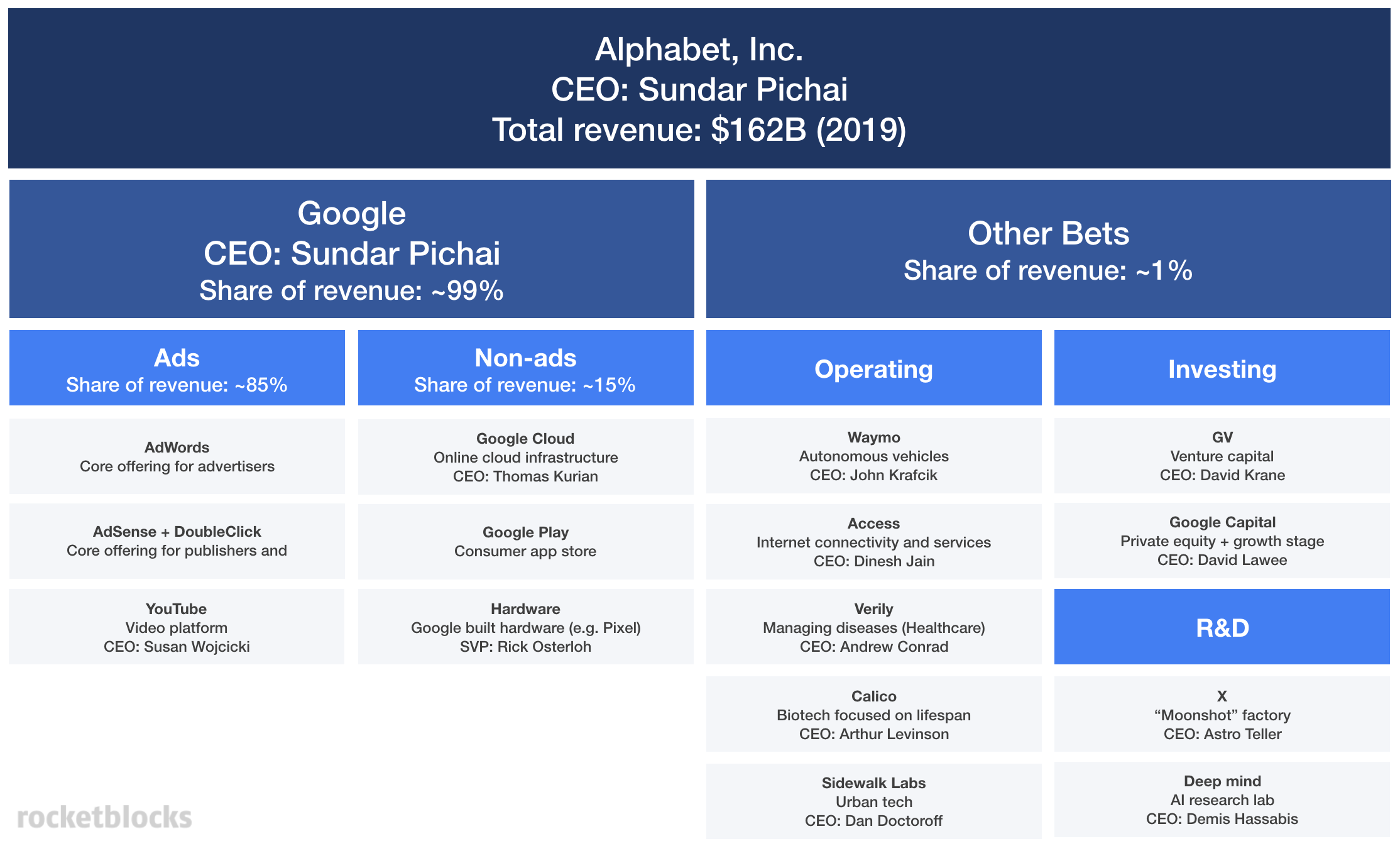

- Alphabet organization, Google units plus Other bets

Where do metrics show up in product management interviews?

First, the good news. No one is ever going to ask you: "How many products with 1B+ users does Google have?" That question doesn't test anything aside from your recall of a relevant fact.

However, there are many instances in PM interviews where knowledge of relevant benchmarks is an important jumping off point for further discussion. Consider the following interview questions:

- How many search queries goes Google answer each day?

- What new business could Google launch that could grow revenue by 5%?

- How could Google grow Gmail users by 10% QoQ?

In each of the aforementioned questions, understanding the rough benchmarks helps tremendously.

For example, if you didn't know Gmail had roughly 1.5B users, you wouldn't have any bearing for the magnitude of 10% more users (e.g., another 150M). Or if you didn't know that Google did over $100B in revenue in 2018, you wouldn't realize that launching a new business that adds 5% revenue means finding a business which can add $5B in revenue.

Timeline of Google's major product launches

The below timeline shows Google's core product launches as they've grown over the years.

The top half of the diagram focuses on core Google products that remain part of Google proper within the Alphabet holding company. The bottom half of the diagram captures the Other bets that the company has made outside of core products.

Key takeaways on Google launches

- Many of Google's flagship products, including Search, Android, Maps and YouTube, were launched over a decade ago.

- Google's track record of turning acquisitions into key products is impressive - with big successes on many key properties like Maps, Android and YouTube.

- The product scope of Google started expanding dramatically in 2008, with the company effectively plowing capital into R&D (e.g., via X and Google Ventures, which is essentially funding R&D)

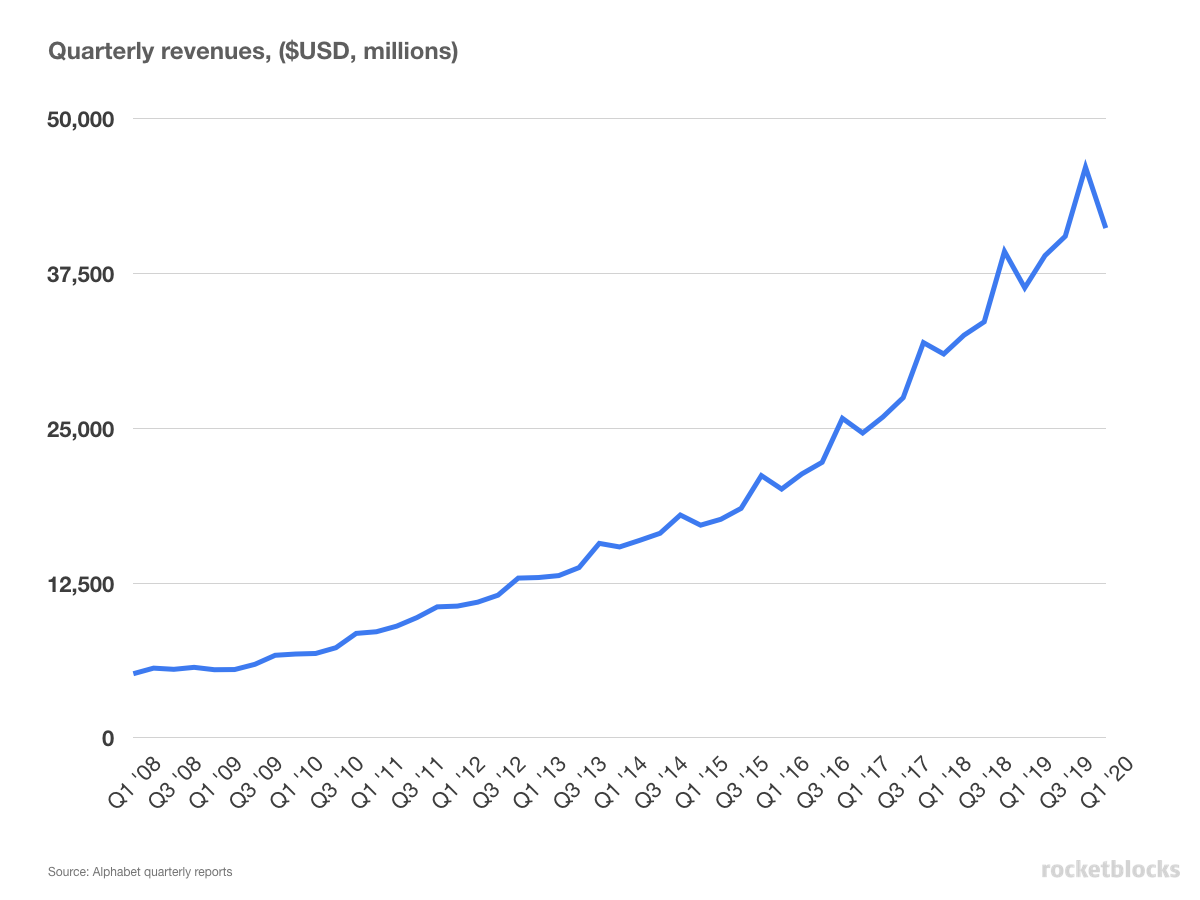

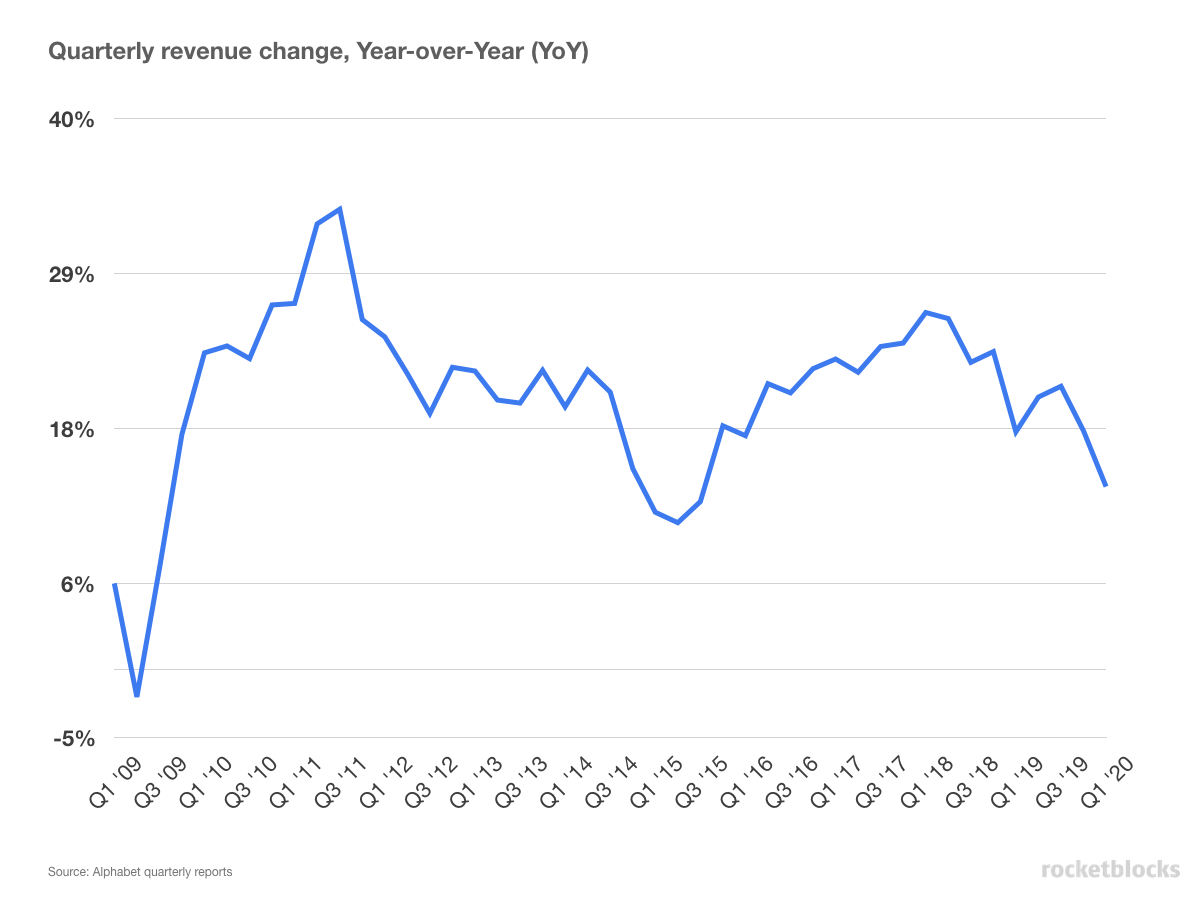

Google revenue growth

Simply put: Google's quarterly revenue growth is astronomical. And the pace of YoY growth they've managed to maintain, with only a few blips (only one negative quarter since 2008) is impressive.

Key takeaways from Google revenue growth:

- Overall, the growth is occurring at a breakneck pace. Google went from about $40B to $115B+ in revenue in 10 years.

- The evidence of the Q4 splurge in advertising is noticeable - this creates the series of "camel humps" we see in the chart between the Q4 spike, Q1 dip and Q2 recovery that they experience each year.

- Google seems to defy the law of large numbers, growing at around 20% YoY every quarter despite the increasingly large benchmarks from prior quarters.

Got a Google interview?

"Rocketblocks was essential in my PM internship prep. Overall, RocketBlocks allowed me to develop crucial PM interviewing skills without which I could not have landed multiple internship offers." -- Anurag Ojha, Google PM, Darden MBA

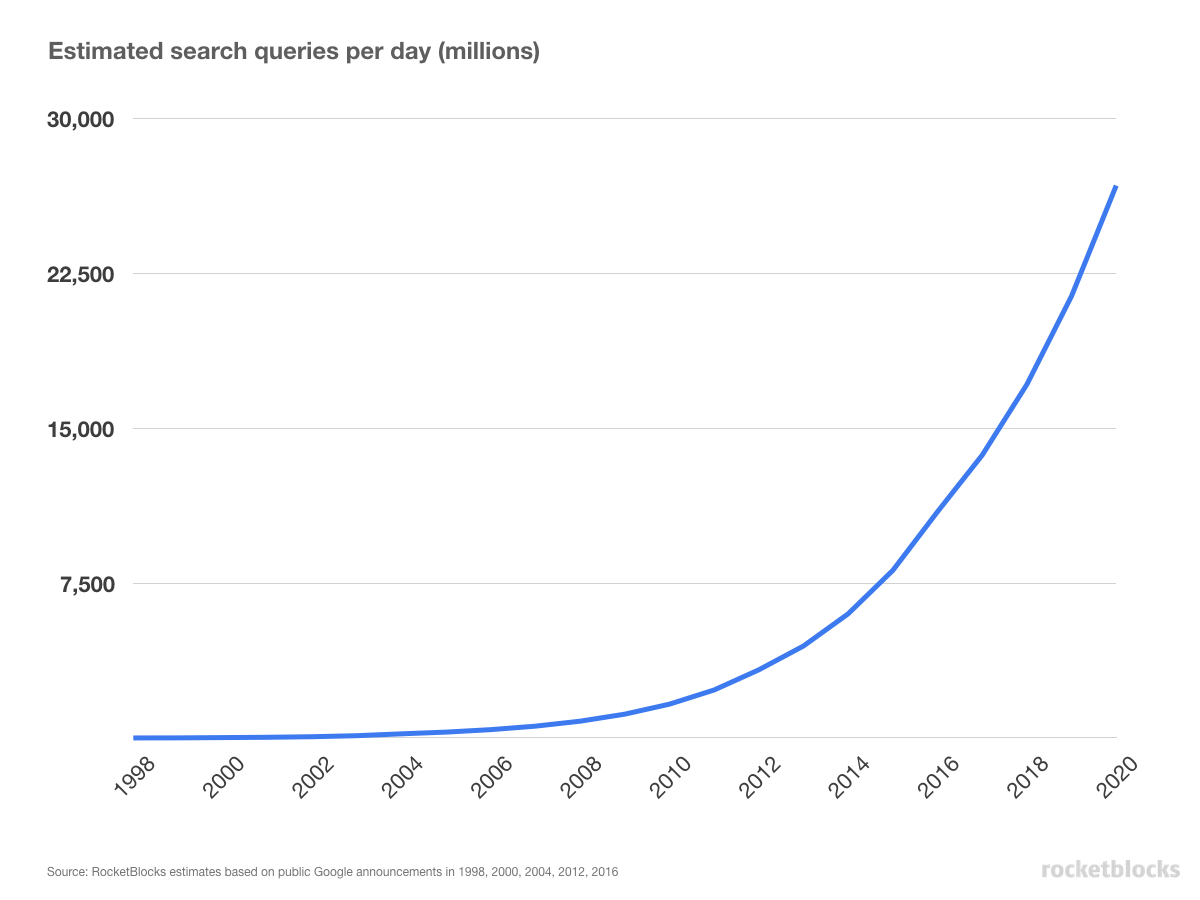

Google search queries per day growth

Digging in further, let's look at the core engine driving the incredible revenue growth: Google Search.

Over the years, Google has publicly spoken about the number of queries they handle (especially in the first decade), alhough they've been more coy with numbers lately. The below estimate is built from public statements from Google executives and extrapolating the trend using a declining growth rate.

Key insights from the Google search volume

- This search query growth helps explain the tremendous growth in revenue: Google's advertising division has had the benefit of monetizing a rapidly growing volume of user search queries.

- Query growth, despite its massive base, continues to grow at an incredible pace as well, which is a great sign for the health of Google's core advertising business.

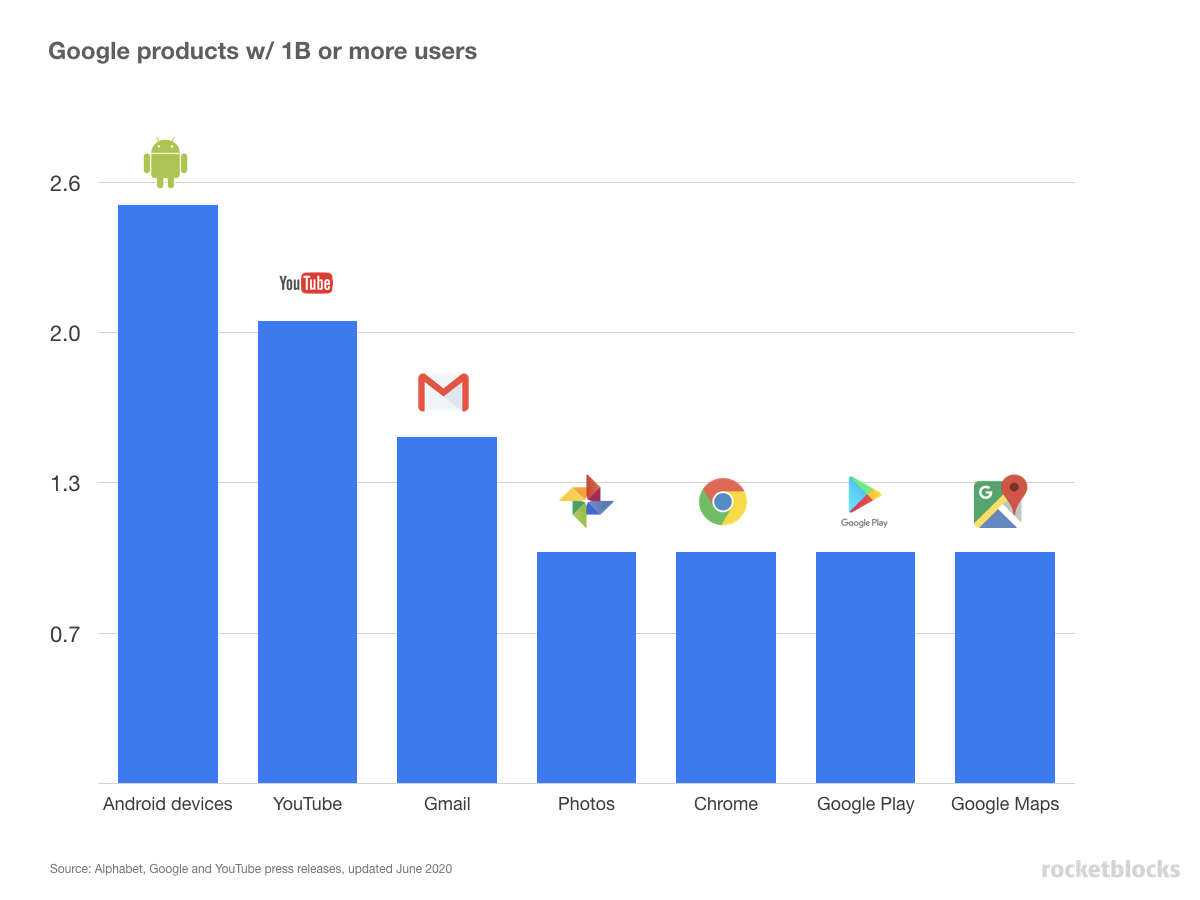

Google's growing user base and product platforms

On the back of Google Search, the company has successfully extended its reach into a new territory.

Some efforts, like YouTube and Maps, are effectively narrowly defined search engines (e.g., "How do I get from location A to B?"). Others, like Android and Chrome, help deliver high quality internet experiences to users and, thus, indirectly drive core metrics like queries.

Key takeaways on Google's user base

- Google's expansion beyond core search has been a success: it has six distinct product platforms serving 1B or more users.

- The coverage of key consumer areas is extensive - entertainment with YouTube, Photos and Play, communication with Gmail and Android and local services (directions, reviews, etc.) with Maps.

- In the next decade, some of these core products like YouTube and Gmail are going to run up against market saturation challenges (e.g., currently ~3B total internet users and a big percentage are in China, where the product landscape is significantly different).

Gmail's user base growth

Let's zoom in on Gmail here, one of Google's key products that more public user counts are available for.

Key takeaways on Gmail's growth

- Similar to both revenue and search queries, Gmail appears to be growing at a healthy clip and showing no sign of deceleration.

- Given Google's increasing push into enterprise products with G Suite (Docs, Sheets, Gmail, etc.), Gmail adoption is likely to find a new growth source there.

Alphabet's organizational structure: Google and Other bets

Here we've outlined the organizational structure of Alphabet, the parent holding company of Google.

Key takeaways from Alphabet's structure

- Google is still the "workhorse" of Alphabet in terms of revenue (99%) and Google itself is still driven predominantly by ads (85%).

- Alphabet has used its ad revenue work horse to fund a staggering amount of iniatives: from lifespan extention (Calico) to autonomous vehicles (Waymo).

- Google appears to be organizing itself strategically so that it can pursue major initiatives that have potential to drive significant revenue growth (e.g., $50B+) in the future.

Summary

Google scale is unprecented.

On all dimensions, users, queries and revenues, Google is not only operating at massive scale but still growing quickly. However, most of that growth has come from a string of extremely successful core products that Google launched (or acquired) between 2000 and 2008.

For Google continue its growth, the next generation of Alphabet Other Bets (e.g., Waymo, Fi, Calico, etc.) will likely need to kick in and help contribute in a meaningful way.

P.S. Are you preparing for PM interviews?

Real interview questions. Sample answers from PM leaders at Google, Amazon and Facebook. Plus study sheets on key concepts.