The unit economics of consulting: how much do McKinsey, BCG and Bain charge clients?

|

|

|

Deliverables | Unit economics | Real McKinsey example

Now that we've got a mental model for thinking about the industry and some of the trends affecting it, let's zoom in and analyze the output of a consulting firm.

Specifically, let's try to answer the question: if a client pays BCG or McKinsey or Bain $1,000,000 for an engagement, what are they actually buying? While it seems rudimentary, a very useful mental model to assess what is actually happening is to ask five simple questions: What? How? Where? Why? When?

What does a $1M McKinsey consulting engagement buy?

Strategic advice, and in the case of implementation work, hands on guidance and step-by-step help on executing it. It's important to note that except in extremely rare cases (e.g., design firms presenting a prototype of a physical product like an IDEO or Frog might do), clients are truly paying for advice and/or guidance.

Thus, it follows that for the client to be happy with the result, the advice must be top notch and be delivered convincingly in a polished manner. We'll return to this in the case interviews and fit sections of this guide. For now, just keep in mind that this structure drives a lot of what interviewers look for in the recruiting process.

How do clients receive recommendations?

Almost invariably, the output is a series of data driven recommendations centering around the problem at hand. The delivery of this output is primarily a presentation, or in many cases a series of presentations (e.g., kickoff meeting, weekly check-ins, mid-project check in, final presentation, etc).

In addition, the supporting data and data assets (e.g., survey results, excel models, powerpoint slides, raw transcripts from interviews) are often, but not always, handed over to the clients as well. However, it is important to note that they key product is the recommendation itself, not the data assets. Ultimately, the data assets are just supporting arguments, essentially by products of the work they did to get to the recommendation.

Where does the work happen?

There is the most variance here as it depends both on the firm itself and the nature of the work. In the majority of cases though, consulting firms tend to co-locate at their client sites for a majority of the week so they can be available for collecting data, interviewing stakeholders, presenting to stakeholders, etc.

Firms like McKinsey and BCG tend to staff the teams at the client site for four days a week, typically Monday through Thursday, and then bring teams to the home office on Fridays. Bain is an exception and, in most cases, attempts to keep consultants working out of their home office, unless there is a need to travel for client research or for a client presentation.

Why? And when?

If you're reading closely, you'll remember we actually covered the "why?" earlier. While there can be all sorts of reasons, it's often because they need 1) functional expertise 2) objective opinion or 3) on demand, world class brains. The "When?" is the easiest question of all: whenever the client needs help.

Unit economics of a consulting engagement

To help bring the above description to life, let's look at a specific, hypothetical case example and examine what the unit economics of the consulting business look like.

Just as in a case interview, you might find yourself analyzing the profitability of a company's product, let's pull apart the revenue and cost structure of a consulting case engagement so we can understand it at a deeper level. This is the same thing you'll do in a case interview, except that, for example, instead of analyzing the profitability of a high end furniture company, we'll be looking at the unit economics of a consulting firm. Let's dive in.

Example: A McKinsey consulting engagement

Let's say a large consumer electronics firm hires McKinsey to help them evaluate whether they should enter the online advertising space via their footprint in digital devices. Based off the initial conversations with the client, the firm agrees to take on the case, allocates a 12-week timeline and agrees on deliverable and a loose framework for the type of analysis and research the firm will do over the course of the case.

💡 Got a consulting interview? RocketBlocks interview prep can help

The top line: revenue of a consulting engagement

For the type of sample engagement described above, the revenue side will likely be the simple part. Clients will agree upfront with the consulting firm on the price of the engagement and what the deliverable will be (e.g., what type of recommendation and analysis will be done).

This type of model is called "Fixed fee", because regardless of outcome, the client will pay the agreed upon fee for the work. While Fixed Fee is a common pricing model used in consulting, it's worth noting that there are a few other alternative models that pop up.

- Fixed fee: As discussed above, this is a single, agreed upon fee for the engagement. In almost all cases, this amount will be paid in cash compensation but in some rare cases it can be paid in company equity or a mix of company equity and cash.

- Time plus materials: This is a model where the firm and client agree on the number of people and type (level, experience) needed for the case and the price that will be paid for each billable hour. While the client will have a good idea of what the engagement will cost, any deviations from the expected timeframe or resources needed could change the picture a lot.

- Milestone based: Here, the firm and client agree on certain case milestones and what fee will be attached to each of them. Thus, the client pays when the firm achieves each of them. This type of model is used almost exclusively in longer implementation cases. For example, this model makes much more sense in a year long case where the firm is expected to help orchestrate a re-org than a ten week strategy case.

A typical strategy case costs between $500,000 and $1,250,000. This variance is driven by the premium the firm is able to command (e.g., McKinsey will usually charge more than say, LEK, because of the premium their brand commands), the length of the case and the number of consultants required to do the work. For our example, let's pick a simple round number to work with: $1,000,000. So, regardless of outcome, unless there is some rare breach of contract from the client or the firm waives the fee, the consulting firm will make $1,000,000 for this 12-week case.

The cost drivers of a consulting engagement

Now, let's look at the cost side. A typical arrangement for this type of case might be something like the following:

- 1 junior Partner, who sold the case, spending 33% of their time on this case

- 1 Principal, acting as the primary day-to-day lead on the case, spending 100% of their time on the case

- 2 Associates, acting as the primary "work-horses" of the case, leading the 3 key work streams the team will be investigating, each spending 100% of their time on the case

- 2 Analysts, helping out the Associates as needed across the work streams, each spending 100% of their time on the case

- 2 Support staff, helping 10% of their time on slide making and research tasks (eg pulling relevant past case work, finding external research)

- Lodging and food: For this grouping, we'll take average expenses times the number of days on the road. For a 12-week case, we'll assume 4 days a week at the client site for a total of 48 days.

- Travel: For travel, we'll assume each person on the case must travel round trip each week to the client site, at an average cost of $800 per ticket. Since there are five team members working full time on the case, and one working 33% of the time (the Partner), and two support staff adding proportionally to their 10% allocation to to the case. Thus, we'll use 5.53 for the calculations.

Personnel costs

| Team member | Quantity (#) | Compensation ($) | Allocation (%) | Year (%) | Cost ($) |

|---|---|---|---|---|---|

| Partner | 1 | $700K | 33% | 25% | $58K |

| Principal | 1 | $400K | 100% | 25% | $100K |

| Associates | 2 | $225K | 100% | 25% | $113K |

| Analyst | 2 | $100K | 100% | 25% | $50K |

| Support staff | 2 | $80K | 10% | 25% | $4K |

| Personnel subtotal | $324K |

Additional costs

| Type | Staff (#) | Days (#) | Daily cost ($) | Cost ($) |

|---|---|---|---|---|

| Lodging | 5.53 | 48 | $300 | $80K |

| Travel | 5.53 | 12 | $800 | $53K |

| Food | 5.53 | 48 | $75 | $20K |

| Overhead | 5.53 | 60 | $250 | $83K |

| Other subtotal | $236K |

Putting it all together

If you put all the aforementioned data together, here is the rough unit economics of a case.

- Revenue: $1,000,000

- Costs: $559,828, $324,250 from personnel and $235,578 from other

- Margin: $485,180 (48.5%)

Key insights from the unit economics of consulting

After considering the unit economics laid out in the example case above, a few key things should start to jump out after letting the unit economics of the above set in. If you're already thinking like a consultant, driving more revenue and improving profitability should be where your head is at!

Insight #1: the cost lever

First, once a Fixed fee or Milestone fee case is agreed upon with the client, there is only one lever the firm has to drive its own profitability and that is bring down costs. Since the vast majority of the cost is labor, this often comes down to reducing labor involved. If you've ever wondered why consultants work so hard, now you have one critical structural clue to the puzzle. Not only is the work challenging but the schedule and economics can be challenging too.

Partners are incentivized to deliver revenue and profits to the firm, so once price is locked in it makes sense to try and staff teams as leanly as possible while still delivering quality work. This structural dynamic has lots of interesting second order effects. For example, many partners like staffing really senior analysts on their teams. Why? Senior analysts are already trained (hence senior) and significantly cheaper than an Associate. For the Partner, it's a win-win, they get high quality work at a discount.

Insight #2: the price and quantity levers

Second, if you want to grow revenue you can either: 1) raise the price 2) lengthen the case or 3) sell more cases. As we talked about above, the strategy firms in particular already play at the high end of the price spectrum, so eeking out more revenue via option number one will be tough. Option number three has also been extensively explored by the firms over the years.

Firms like McKinsey, BCG and Accenture are incredibly good at designing cases which solve the core problem at hand and lead naturally into explorations of next steps (and next cases). This is generally referred to as "rolling", as in how do you roll the conclusion of one case into a brand new case (and thus new revenue)! Thus, if we look at the remaining option, one of the big greenfield opportunities for the strategy firms is how do you lengthen the case while not letting go of your progress on options one and three? You continue to sell follow on strategy work but simultaneously sell follow on implementation work as well. As we discussed, this is a big driver of the continued evolution of firms like McKinsey and BCG.

Real life example: McKinsey's covid-19 response pitch to the State of New Jersey

Typically, the actual pricing of consulting engagements is a closely guarded secret.

Even at the firms themselves, pricing is handled by senior staff and more junior associates and consultants aren't privvy to full the details. On the client side, it's a similar situation. Typically, only senior management like Directors, VPs and C-level execs know the full details and costs.

However, occasionally certain documents will surface in the public domain, and this is highly educational for us! Here you can find the full 16-page McKinsey proposal on covid-19 response to the State of New Jersey. We'll pull out the good stuff and highlight it below: the pricing for the different engagements.

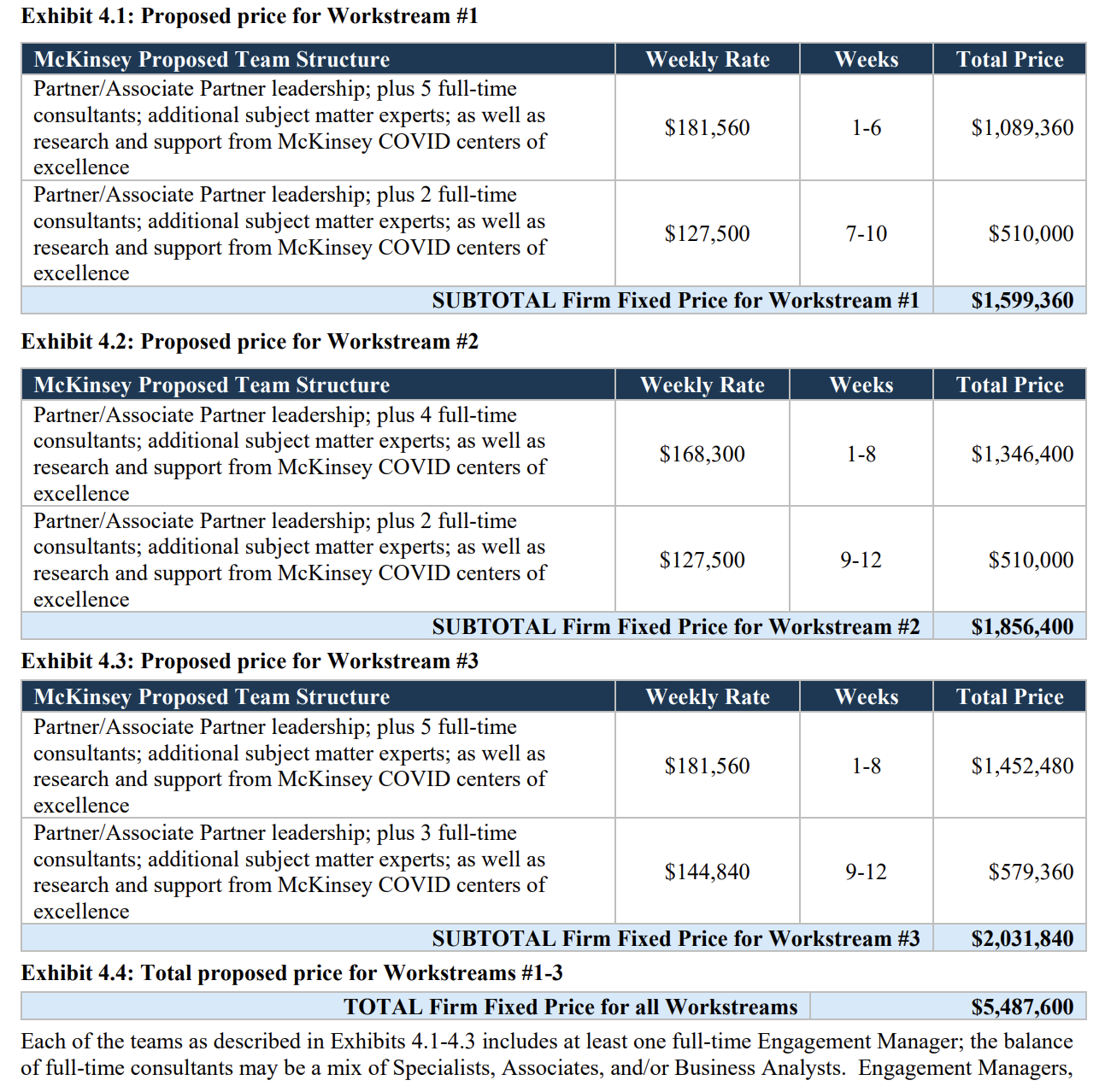

Below you can see various workstreams that McKinsey has mapped out, the number of consulting staff assigned to each one, the length of the engagement and the total cost.

Where do you fit in?

The next key question is where you fit into this picture. Let's start by looking at the entry points into the consulting business, what salaries are available to you and what your career progression could look like.

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.