Profitability case interview questions

An overview of profitability cases, the key framework and an example case

|

|

|

Case types | Key framework | Example case

While consulting cases rarely fit into textbook frameworks, there are several common types of cases that are brought up in interviews frequently enough that it's useful to get familiar with them. Market entry cases are one example, and profitability cases, which we'll focus on in this post, are another.

Profitability cases are important because they get to the root of a business's success or downfall; they focus on how much money is made after accounting for costs to run the business. Understanding the components that go into calculating profitability is a crucial first step to cracking these cases, and in showing your business acumen during interviews.

We'll explain how to recognize a profitability case below, then go through one framework that can be used to solve them, as well as a detailed example that illustrates the framework in action. Remember, these frameworks are not meant to be copy-paste templates to solving cases, rather they should provide an example of a structured way of thinking about a certain type of problem.

Common types of profitability cases (Top)

Profitability cases are fairly easy to recognize, as they'll typically reference one or more of the following scenarios in the problem statement:

Changing revenue, cost, or profitability

"Frank's restaurant chain has seen profits stagnate recently despite an increase in customers, they want to understand why?"

Launching a new product or growing into a new market

"Main St. Outdoors store is looking into expanding their current footprint by launching in a nearby city, how would you evaluate if this move would be profitable?"

Performing a cost/benefit analysis or presenting a business case

"Anne launched an apparel company that does all their manufacturing in the US. She's now considering outsourcing to a lower cost country. Is this a good idea?"

Profitability framework (Top)

Once you've identified the type of problem you're being asked to solve, the next step is approaching it in a structured way. We'll go through the 4 main steps below:

Get comfortable with your levers

Profitability cases are generally focused on drilling down to uncover the lever that's driving a change in the business. For this reason, you'll want to be very comfortable with the components of profitability and how they impact each other. If you haven't already, we'd recommend memorizing the following relationships:

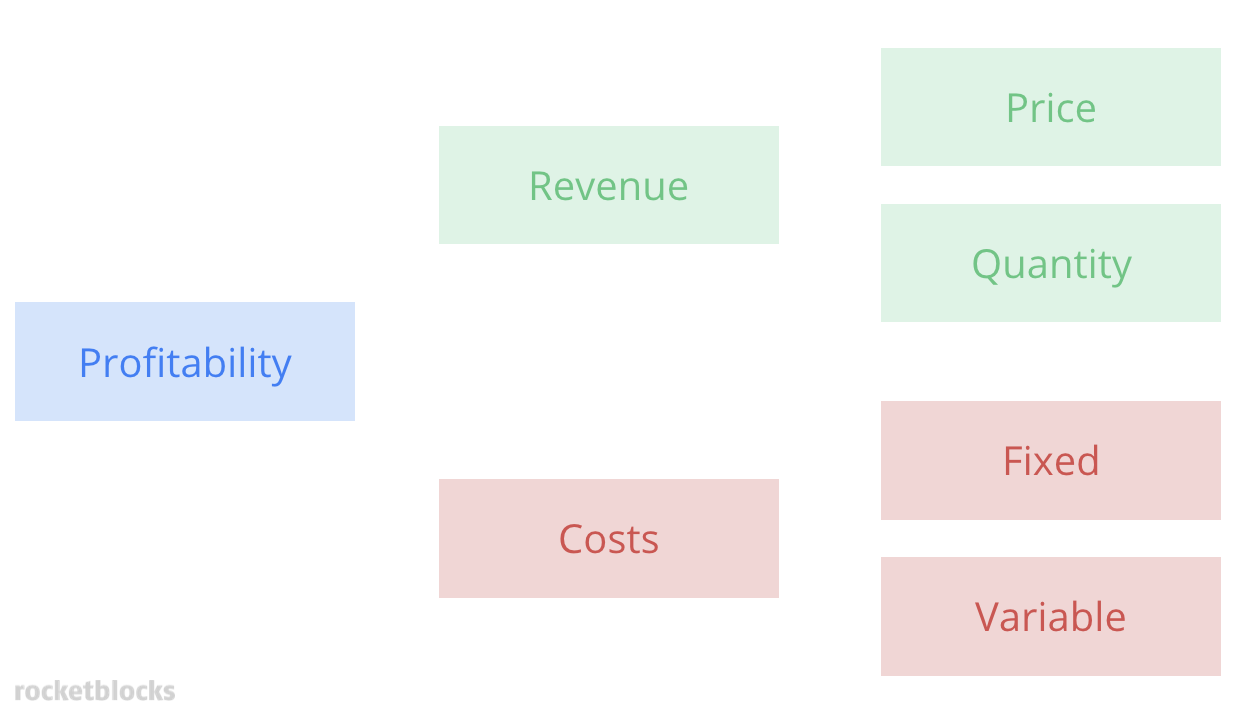

- Profit = Revenue - Costs

- Revenue = Price x Volume of Units

- Costs = Fixed Costs + Variable Costs

- Variable Costs = Cost per Unit x Volume of Units

Fixed costs don't vary based on sales. Examples include rent, salaried personnel and annual dues or fees. Variable costs are tied directly to sales. Examples include costs of materials and hourly labor.

You can nicely map profitability into a simple, MECE framework (see below).

In an actual interview, you'll want to go beyond the basics and specify the key revenue and cost drivers for the case problem at hand. For example, if you're working on a case in the restaurant industry, you might write down (and voice over) that revenue would be calculated using avg. table bill x avg. number of tables served per day x days open.

Drill down to the components

- Identify which of the levers are given to you in the problem statement, and which one(s) you'll be trying to find.

- Take an educated guess about which lever is driving the change, and begin working out the numbers to prove or disprove your hypothesis.

- Work through the remaining levers as you learn additional information throughout the case.

- By the end of the case, you should have an understanding of each component and how they collectively impact each other.

💡 Shameless plug: Our consulting interview prep can help build your skills

De-average & customize the components

Before suggesting any recommendations based on your findings from the component break-down, see if it's possible to segment the cost or revenue components further in order to uncover any additional insights around profitability that are unique to the company you're looking at. This step may be done concurrently with the previous step, as you collect additional information.

Common segmentations on the revenue side include:

- By type of customers e.g. business vs. leisure, or free users vs. subscription users

- By geography e.g. east coast vs. west coast store locations

- By product e.g. printers vs. ink

- By business model e.g. selling a product (car) vs. selling a service (maintenance on the car)

Segmentation is an important step because it can lead to key findings that otherwise might remain hidden. For example, at a high-level, revenues for a company may look stable, however you might segment by product line and see that one product actually has negative profit margins e.g. it's being sold at a loss. This is an insight you wouldn't uncover without de-averaging.

Provide a recommendation

Once you've developed a view on what's driving the profitability problem, suggest steps the company could take to solve it. These recommendations could take many forms, from adjusting the cost structure, to investing in marketing for a specific segment, to changing the price of a product.

Describe what impact you might expect to see if your recommendations were implemented and how the other profitability components could vary. For example, if you're suggesting a company outsource their manufacturing to variabilize more of their costs, note that this could have a negative impact on quality, leading to a decrease in sales.

Example profitability case (Top)

Now that you've seen the framework, let's go through a profitability case so you can see it in action. We'll go through each of the steps to explain how the framework might be applied to a real case. Don't forget that frameworks are just one tool you can use to crack a case. Make sure you use your business acumen as well and think through the unique aspects of any problem.

“Our client, 24 Hour Fitness, has experienced decreasing profits over the past year. How would you approach this problem and what recommendations would you make?”

Get comfortable with your levers

We're given that profits are decreasing. From Profits = Revenues - Costs, we know that either revenues have gone down or costs have gone up.

We're looking at the fitness industry, so we might write down that revenues = avg. # of monthly members x monthly rate x 12.

On the cost side, we note that fixed costs would include rent, salaries for full-time staff and workout machines. Variable costs could include laundry and cleaning, amenities, and any hourly fitness instructors.

Drill down to the components

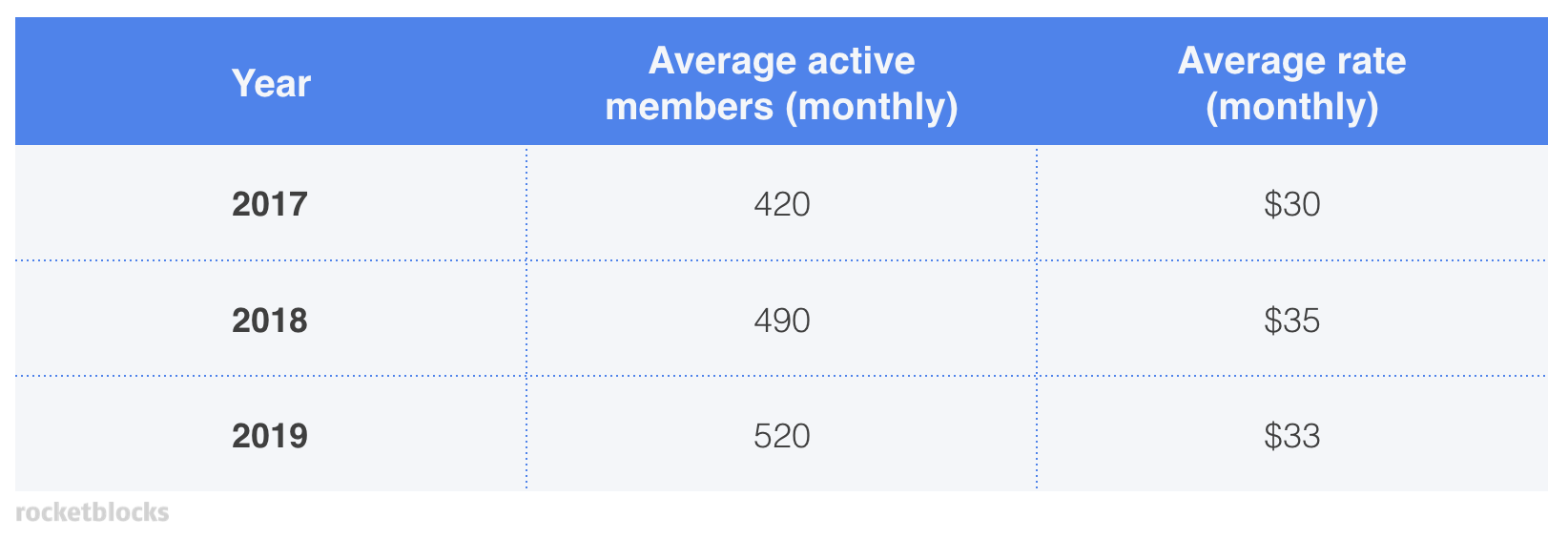

At this point, we might guess that revenues have been decreasing, so we ask for data about memberships over the past few years and are given the following information:

From a quick look at this table, we can see that revenues don't appear to be the issue. Membership and fees have been fairly stable over the past few years.

Next, we'll turn our attention to the costs, as these must have been increasing at a faster rate than the revenues were. We could ask if there is any data around historical costs. We're given the following:

From this data, we see that rent and personnel have been increasing, but personnel especially has ballooned over the past few years. We need to find out what's driving this big jump.

De-average & customize the components

To dig into the personnel cost bucket, we'll want to think about the industry a bit. As we mentioned at the beginning of the case, personnel costs could fall into two categories - full-time and hourly. It would be interesting to see which type this cost increase is tied to.

Applying what we know about gyms, we might think about the customers. At the gym, there's a portion of customers who sign up and never go, there's a portion that go and do their own thing on the equipment, and there's a portion that go to the instructor-led workout classes. What if our normal ratio of these customer segments has shifted over the past few years, and this is somehow leading to higher costs?

In order to test our hypothesis, we'd want to ask for additional data. For example, if there is any historical information around the average gym or workout class attendance of members. This data is shared:

Now we've found something interesting. We see that the average number of workout classes held per month has increased by a factor of 4 in the past 2 years.

It turns out that the gym has been offering members classes for free (included in their monthly rate), yet as they've gained in popularity and added more to the schedule, they've had to add a large number of expensive hourly instructors to the payroll, which are driving up the personnel cost. Despite attracting more customers with their packed class schedule, they haven't increased prices to account for the higher cost.

Provide a recommendation

By this point, we've figured out that higher costs have been driving the decrease in profitability - rent and personnel costs have increased by $5K per month ($3,000 + $2,000) between 2017-2019, however revenues only increased by $4,560 ((520*$33) - (420*$30)) during the same period.

Alternatively, they could change their pricing structure to lower the fee for using equipment but charge a drop-in price for attending a class. This might be a way to prevent losing customers that don't attend classes. Finally, they could take a look at hourly instructors' rates and see if transitioning a couple to full-time employees, or finding personnel that could both run the desks and teach classes would be cheaper options.

Conclusion

This case shows how our profitability framework could be used to work through a case in a structured way. However, you can also see the importance of critical thinking and creative problem solving in coming to a tailored solution - two skills consulting firms will be looking to test. Make sure to practice these until you feel comfortable enough with the framework that it becomes second nature - allowing you to spend your time cracking the case itself.

Explore profitability cases

Read this next:

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.