Market sizing case questions

An overview of market sizing cases, two example cases and a 3-step approach for solving them

|

|

|

Question context | Example question #1 | Three-step approach | Full solution #1 | Example question #2 (video)

Market sizing case questions are a core part of the consulting interview process.

For decades, leading consulting firms like McKinsey, BCG and Bain have used them to assess candidates' quantitative abilities. In fact, they've been so effective that many tech companies have followed suit: it's not uncommon to get a market sizing question in product management or product marketing interviews at companies like Google.

Why ask market sizing questions? (Top)

In the beginning, firms asked hypothetical questions which exclusively tested a candidate's estimation skills.

It didn't matter if the situation was whimsical or had zero practical business implications. For example, a candidate might get the question: "Please estimate how many golf balls you could fit inside a 747 plane."

It's an interesting intellectual exercise. However, as an interview question, it has a crucial flaw: it doesn't truly test skills beyond pure quantitative ability. The solution: a true market sizing question!

Today, firms focus on a more sophisticated style of estimation question: the market sizing question.

These are estimation questions with added depth that test the candidate's ability to pull in relevant knowledge and make reasonable assumptions about consumers, businesses and markets.

From the firm's perspective, this is a higher leverage type of question to ask because it simultaneously tests 1) quantitative skills 2) logical reasoning and 3) business acumen.

An example market sizing question (Top)

Let's look at a sample market sizing question for the rest of this discussion.

Your client, a leading pharmaceutical company, is planning to introduce a product to compete with Botox, which currently holds a near monopoly in its market. You would like to estimate the current size of the market in the US, which derives about half its revenues from cosmetic uses and half from therapeutic uses.

This particular question is focused on the healthcare industry but exhibits all the core traits of a market sizing question that could come up in any case interview! Below, let's apply a three-step approach to working through it.

Three steps to approaching a market sizing question (Top)

For any market sizing question you face, whether the whole case is one giant market sizing question or you find a mini-market sizing exercise embedded within a large case, we recommend taking three steps:

- Structure your approach

- Make assumptions and round your numbers frequently

- Sanity check your answers

#1: Structure your approach

Before jumping into any given market sizing question, it's important to lay out how you'll approach the drill.

You can take any market sizing task and break it down into a few key component parts. Then, you can work through each component independently and put all the parts together for the final answer.

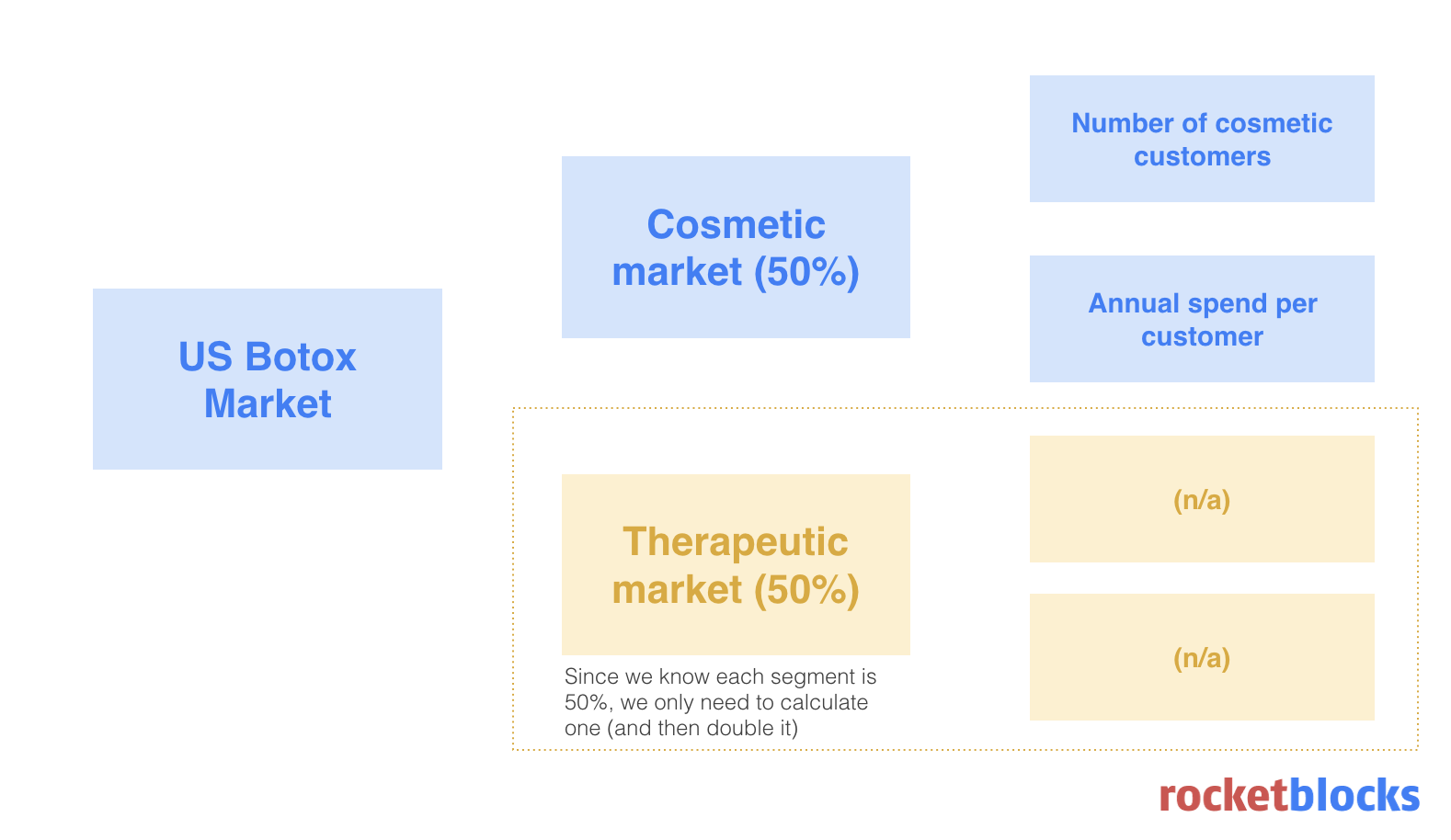

For our sample question, sizing the US Botox market, we can start by organizing the key info. We know from the question that the cosmetic market is 50% of the total thus, if we can estimate the cosmetic market, then we can easily scale up by 2X to estimate the full market size.

Next, if we zoom in on the US cosmetic market, then we can define it as equal to the number of cosmetic customers multiplied by annual spend per customer.

#2: Make assumptions and round your numbers frequently

Now that you've got a structure in place, you'll need to make assumptions and calculations to get to your total estimate.

Here, the key is to assume often, and always round your numbers to make them easier to work with. Additionally, after you do any calculation, if the result is a messy number, then you should round that number before you use it in a subsequent calculation.

Caution! Don't chase the false precision gods of market sizing

At times, candidates avoid rounding because they think it will be impressive if they do incredibly precise math and get it right. A word of advice: avoid this trap like the plague.

It's a double whammy because:

- You're more likely to get calculations with messy numbers incorrect

- Interviewers don't give you credit for making the problem harder than it should be

Consultants pride themselves on simplifying messy problems. Thus, needlessly complicating a problem with messy numbers isn't going to win you points. In fact, it's counter productive.

Returning to our example, if we want to first calculate the number of US cosmetic customers, then let's start by making some assumptions and rounding as needed:

- Assume the US population is 300M

- Assume that 50% of the population is women

- Assume that the population is evenly distributed between ages 0 and 80

- Assume that the population aged between 40 and 80 is the relevant population

- Assume that 20% of relevant aged women might be able to afford and are interested in using Botox cosmetically

With these nicely rounded assumptions, calculating the number of women in the relevant population is nice and clean: 300M people * 50% women * 50% relevant age * 20% use = 15M women.

💡 Shameless plug: Our consulting interview prep can help build your skills

#3: Sanity check your numbers

Finally, after any series of calculations, it's helpful to sanity check your estimate and make sure it passes the smell test. While it's not necessary after every single calculation, sanity checking numbers after series of calculations and, of course, at the end of the exercise, is helpful.

For example, consider the calculation we just did above. If we were “off by a zero”, which is a common error to make in a series of calculations, then we might have ended up with 150M women. Given that 150M women would be all the women in the US (given a 300M population and 50% of the population is women), that would be a crazy result. It implies that *all* women in the US use Botox cosmetically. Smell test fail.

However, the current number of 15M is 5% of the overall population. While it might seem a little high, it feels plausible that some single digit percentage of the population might use Botox cosmetically.

Full market sizing solution (Top)

As you go through a whole market sizing exercise, you'll essentially be repeating the steps above to work toward an overall estimate.

For the US Botox market, here is the step-by-step calculation one of our RocketBlocks Experts used to estimate the market. As you go through, pay special attention to the structured approach and the use of round numbers to simplify calculations. In addition, try to test yourself by periodically sanity checking a few numbers as well.

| Type | Description | Value(s) |

|---|---|---|

| Assumption | Population of US | 300M |

| Assumption | Cosmetic use is almost exclusively women | 50% women |

| Assumption | Population is evenly distributed between ages | Ages 0 to 80 |

| Assumption | Relevant population is ages between | Ages 40 to 80 |

| Calculation | Number of women in target market: 300M * 50% women * ((80 - 40) / 80) | 75M |

| Assumption | Only used by the top X% of earners | 20% |

| Segmentation |

|

|

| Assumption |

|

|

| Calculation |

|

|

| Calculation | Total annual cosmetic treatments for women: 1.5M + 375K | 1.875M |

| Assumption | Average cost of a treatment | $200.00 |

| Calculation | Size of cosmetic market for women: 1.875M * $200 | $375M |

| Assumption | There is some small percentage of cosmetic market which is men (%) | 5% |

| Calculation | Cosmetic Botox market for men and women: $375M / 95% of the market | Roughly 400M |

| Calculation | Total Botox market (cosmetic + therapeutic): $400M / 50% of market is cosmetic | $800M |

Thus, the final estimate is $800M.

A quick Google search turns up some market research which suggests the overall US market size is $1B and growing quicky (source data here). Not bad!

Video example: estimating the US quick service breakfast market (Top)

For another example, check out this video of me solving a market sizing question live.

In the video, we illustrate three different approaches to this question: a weak approach, an OK approach and a great approach. Finally, in the conclusion, we provide a compare and contrast and point out why the great answer really sets itself apart.

NOTE: For context, you can also check out Part I and Part II, which immediately precede the market sizing exercise below.

What about a bottom-up solution?

Earlier, we used a top-down solution as part of the three-step approach to market sizing questions. However, it is possible to solve with a bottom-up solution as well - although this can be tricky and is not my recommended approach (more on that later).

In a top-down solution, you start with the largest possible number (e.g., the US population) and divide by various factors until you get an estimated result.

Conversely, a bottom-up solution starts with the smallest possible number (i.e., one individual out of an entire given population) and works from there until you reach your final estimate.

For example, we could calculate the market size of shampoo with a bottom-up approach:

- You start with one person out of the entire US population.

- Estimate how many shampoos a person uses per year (e.g., 8).

- Estimate the average cost of shampoo (let’s say $3).

- Multiply the above factors to get the annual shampoo expenditure of an average American (so $24).

- Consider how many Americans regularly purchase shampoo (with a population of around 300 million, let’s say about 250 million buy shampoo frequently - or have shampoo bought for them if they are dependent on another person).

By using the above calculations, we get a total of $6 billion for the annual market size of shampoo. With a quick Google search, we find the answer to be almost $4 billion. So, as you can see, the bottom-up approach to market sizing case questions can also work.

Here's the risk with the bottom-up approach: most markets have lots of segments, niches and nuances (e.g., think of luxury vs. basic products) and the implications of that - different price points, buying cadences, and so on.

Given that, it is often easier to start with the overall population and then consider how you'd like to segment it first - then once you've enumerated your segments you can estimate price points, buying cadence, etc. for each segment.

Preparing for market sizing case questions

Here is a complete list of steps to prepare for market sizing questions:

- Ensure you understand the two solutions to such questions - Understanding the nature and workings of the bottom-up and top-down solutions to market sizing questions is one aspect of ensuring you are prepared.

- Learn our three-step structure - As mentioned earlier, make sure you remember to structure your approach, make assumptions, and round up frequently, as well as sanity checking your answers.

- Memorize relevant data - Obviously, guesstimates are a core aspect of market sizing case questions, and thankfully, they will often bring you within the 50-200% range of the actual answer (i.e., if the answer is, say, $500 million, there’s a good chance your estimate will be in the range of $250 million to $1 billion). However, memorizing basic data points can be useful. Examples include the US population, the number of Americans who are adults, and the number of married Americans. It’s also worth looking up the average cost of commonly purchased items.

- Practice market sizing - Give yourself several market sizing questions to work on (e.g., the market size of toothbrushes in the US or the market size of Ford cars in the United States). By practicing, you will not only get used to the approaches required for these questions and improve your calculation skills, but it will also allow you to see how close your estimates are to the actual answers. If your calculations are in the 50-200% range of the actual answers, you’re on the right track.

Whether you are in the midst of a management consultant career path or at the beginning of your career, RocketBlocks can launch your career forward. Check out our website for more information on how we can help you advance your interview skills.

Alternative market sizing questions

Market sizing case questions directly relate to the revenue generated by a given market over a certain time period (usually one year). However, you may be asked to make slightly different calculations that are connected to the size of the market. In some cases, interviewers may even ask you about specific companies, although this is unlikely.

Here are some examples of alternatives to conventional market sizing questions:

- How many of X are sold per year?

- How many people own X?

- How many people buy X each year?

- How much does [insert name of company] make each year?

- What is the monthly revenue of [company name]?

Examples to work on

You may be wondering where to start when it comes to practicing market sizing questions. Thankfully, we’ve provided some examples to work on below. Some of the questions are medium-sized, whereas others are large-scale (i.e., nationwide) questions.

Here are some examples of market sizing case questions (and examples of related alternatives):

- What is the annual market size of smartphones in the United States?

- How many chocolate bars are sold in New York every year?

- What is the size of the yearly piano market in the US?

- How many takeaway coffees are sold in New York annually?

- How many Teslas are sold every year in the United States?

- How many coffins are solid in the US each year?

- What is the market size of PCs in the United States?

- What is the annual revenue of American Airlines?

- How many beers are sold at the average LA Lakers basketball match?

- How many Americans have a TikTok account?

- What is the market size of toothbrushes in the US?

- How many Americans aged 18-30 own a car?

- What is the market size of toilet paper in the United States?

- What is the market size of Wilson footballs in the United States?

- How many Bud Lights are sold each year in the US?

Again, you should use your best judgment to determine whether to employ a top-down or bottom-up solution. While using both and obtaining an average would likely give you an estimate closest to the actual answer, since time is of the essence in a job interview, you should pick one approach only.

For more information, have a read of our blog. We explore topics ranging from M&A case studies to strategy and operations.

Looking for more market sizing drills?

If you're looking for additional market sizing drills, then RocketBlocks can help with that.

Our market sizing drills each come with a detailed answer like we walked through above, as well follow-up questions to further test your knowledge. You can sign up for a free trial today and give them a try.

Explore market sizing cases

Read this next:

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.