Product management in fintech

|

|

|

Product Sense | Product Analytics | Product Strategy | Product Execution | Domain knowledge | Collaboration | Technical chops | Example question walkthrough

What is product management in Fintech?

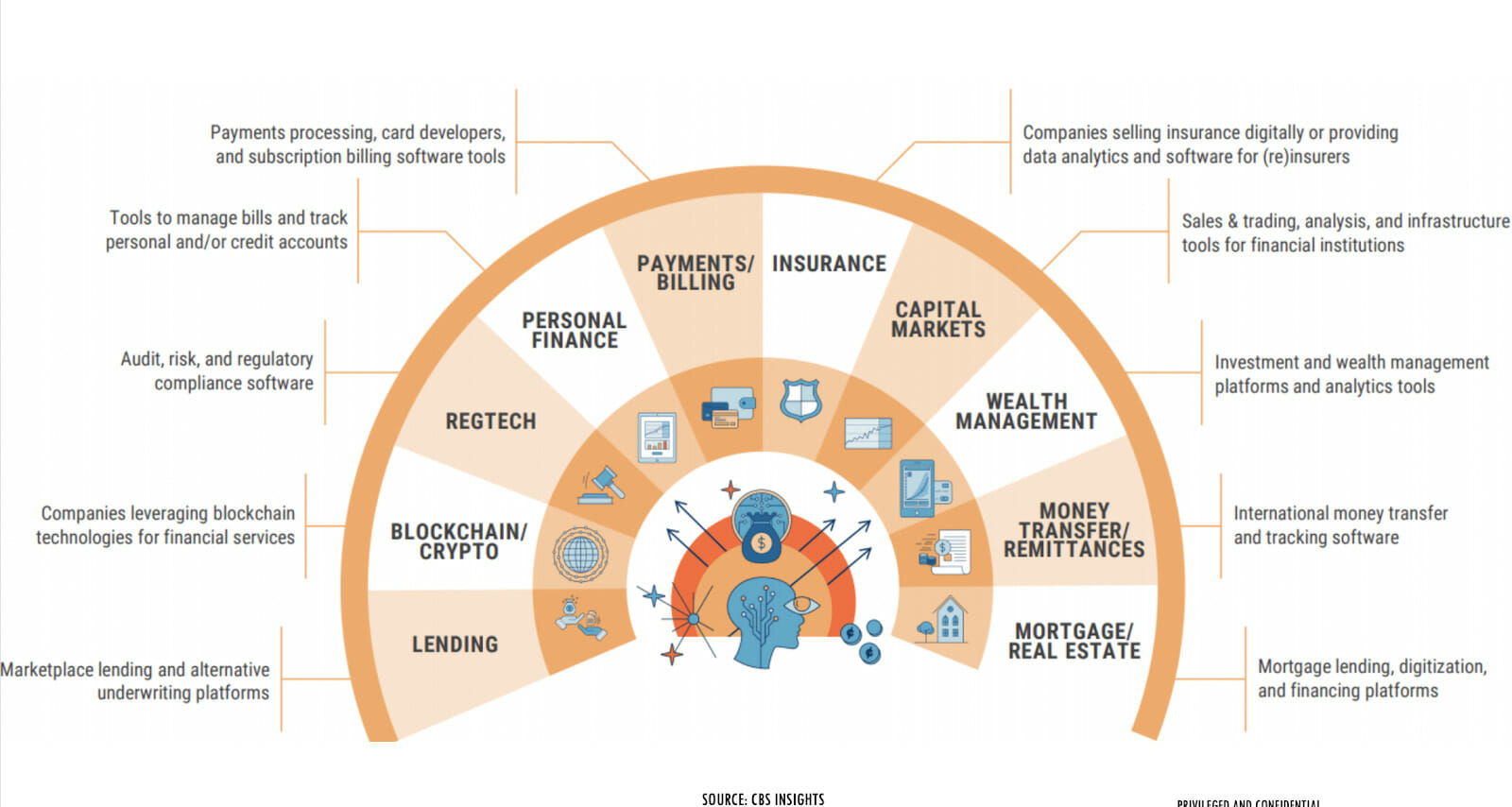

Fintech or Financial technology is simply the use of technology to solve financial needs of consumers and businesses. The financial needs here are broad and encompass borrowing, saving, transferring, tracking, selling, investing, lending and accessing money from an entity.

Traditionally, a PM works closely with the Engineering, Design, Analytics, and Marketing teams. At Fintech, I not only work with those teams, but also with Risk, Compliance, Legal, Credit Operations, Partnerships, Business Operations, Member experience and Financial Operations. With so many stakeholders, the PM role becomes even more critical: after all, it is the PM’s responsibility to deliver a great product, and all these teams are essential to making that happen.

What interviewers are looking for in Fintech PMs

Most Fintech companies are looking for the all core competencies that make a great generalist PM. You are tested for core competencies across Product sense, analytics, strategy, technical acumen and collaboration/leadership skills.

#1: Product Sense (Top)

Can you design member focused experiences that delight users?

This is a core skill for any product manager. Customer centricity applies to Fintech PM as much as for a social media PM (say). Today, the most successful fintechs are winning by building products directly focused on customers.

The best way to build this spidey sense or intuition on what makes a great product vs good enough is to:

- test out the products in your app store

- perform a thorough tear down

- understand the users, the needs and value prop deeply.

The secret sauce is to empathize deeply with fintech users.

For example: Chime understood that the majority of Americans were living paycheck to paycheck and decided to provide early access to their pay check and won the members with $0 overdraft fee.

Product Sense interview questions in fintech:

Sample question #1: Design a joint accounts product offering for a neo-bank

Sample question #2: How would you build an MVP for an NFT marketplace?

Sample question #3: Design a crypto trading platform for retail investors

Sample question #4: Design a personal finance product that helps people manage their savings better

Sample question #5: If you were a PM at robinhood, what would you build next?

Sample question #6: Design a peer to peer money transfer product

Sample question #7: Define the MVP for a small business credit lending product

#2: Product Analytics (Top)

Can you glean insights from data to inform the next iteration of the product?

In fintech, we track similar categories of metrics like north star, usage, funnel etc but counter metrics is an area which I feel is slightly more unique to fintech.

For Example: For a digital banking company like chime- Fraud losses, chargeback rate, transaction processing costs are some metrics you need to keep a tab on constantly. You don't want to expose your product to fraudulent actors or lose a ton of money on partner commissions making your products unprofitable.

Product Analytics interview questions in fintech:

Sample question #1: There is a 10% drop in the number of Direct depositors at a neo-bank. Why do you think this happened and how do you fix it?

Sample question #2: What metrics would you use to measure success of a credit card product to help subprime customers boost credit scores?

Sample question #3: We’re seeing a 20% drop in the $ value of transactions exchanged between peers. How would you diagnose this?

Sample question #4: We are seeing an increase in fraud losses for our debit card product. How would you fix this?

#3: Product Strategy (Top)

Can you set a bold vision and a solid strategy to get to that vision?

The Fintech industry is rapidly changing with so many new players unbundling the traditional banking stack , deploying latest technologies like blockchain and going fully digital. Every company today has an element of Fintech baked into their strategy so winning here is non-trivial without a solid strategy.

For example: A neo-bank like chime has to constantly think of how they can evolve their value prop once big bank start offering $0 fee and early access to pay. This requires long-term thinking.

Product Strategy interview questions in fintech:

Sample question #1: Do you think robinhood should offer a credit card product?

Sample question #2: What do you think is the future of Buy Now Pay Later (BNPL) sector

Sample question #3: How do you reduce operating costs of Chime?

Sample question #4: Do you think Stripe should offer a small business lending product?

Sample question #5: hat makes a cash app sticky?

Sample question #6: How would you think about providing banking services to the underbanked without credit history?

💡 Got a PM interview? Our PM interview drills help get you in top form

#4: Product Execution (Top)

Can you orchestrate a cross-functional team to effectively build and launch a feature or product?

This again I feel is uniquely challenging for Fintech. Any feature launch at a Fintech product company has to go through tons of approvals across risk. Legal, banking partners, compliance partners, Finance etc. This makes execution feel slow and process heavy.

For example: To launch a simple change to say transfer/withdrawal limits, we need to get approvals from all the above stakeholders and also ensure we communicate ‘Change in terms’ with our members.

Product Execution interview questions in fintech:

Sample question #1: Design an experiment to test a P2P lending product

Sample question #2: How would you rollout a new payment method

Sample question #3: What distribution channels would you pick for launching a retirement savings product?

Sample question #4: Design a go-to-market plan for a new investing product

#5: Fintech domain knowledge (Top)

Although not a necessity, domain knowledge will give you an edge. I personally started investing time in learning about Payments, Billing, fraud, Identity, web 3 etc. Even though we are closely involved in the eco-system as consumers, It's a complex space that very few understand. I strongly recommend reading ‘Anatomy of a swipe’ for starters and skim through some terms with Payment Terminology for Product Teams so that you can understand and speak the jargon more confidently.

Fintech domain knowledge interview questions in fintech:

Sample question #1: Explain what happens when you swipe a card at a merchant?

Sample question #2: How does the dispute cycle work?

Sample question #3: What are the different payment rails and its use cases?

Sample question #4: What web3 technologies are you most familiar with? What is defi? Blockchain etc.

#6: Cross-functional collaboration (Top)

As a fintech PM, you need to put in extra effort to align and work well with partners who range from Risk, Finance Legal, compliance, banking partners, network partners etc. Oftentimes all these teams have competing goals and its the PM job to rally this group towards a common objective. You should be great at handling conflicts, evaluating tradeoffs and making decisions quickly.

Cross functional collaboration interview questions in fintech:

Sample question #1: What is the hardest decision you've ever made as a fintech product manager?

Sample question #2: How do you handle conflicts while working with risk, finance and partnerships?

Sample question #3: How would you manage platform investments versus feature development for a financial product?

Sample question #4: How can you accelerate product development speed for building and launching a highly regulated product?

#7: Technical chops (Top)

The room for error is minimal in fintech products as we are mostly dealing with people’s finances so a strong understanding of reliability, infra would really help in building robust products. As a Fintech PM, you are expected to have good systems thinking and invest in building robust platforms along with delightful experiences. You should form a strong partnership with engineering and design systems for resilience, security and correctness at scale.

Technical chops interview questions in fintech:

Sample question #1: Design a stock trading platform like Robinhood

Sample question #2: Develop an algorithm to assess credit worthiness of a potential customer

Sample question #3: Design a real-time stock picking ML model

Sample question #4: Develop a mechanism to forecast the value of a NFT piece

Fintech product management question walkthrough (Top)

"You are the PM for a neo bank named ‘JioBank’. Design a joint accounts product to help customer manage funds in partnership"

Step #1: Ask clarifying questions to align on scope

Before diving into designing the product, you should be grounded in the rationale behind this investment. I would assume that JioBank want to increase the number of active members and also the total deposited dollars through this product. JioBank already has an individual savings account product which members love and they see that 60% of its members are part of the same family and would like to manage funds together.

In general, some questions to discuss and seek answers to would be:

- What is a joint account?

- Why is it important for JioBank to offer joint accounts?

- What's the key customer insights driving this investment?

- Why now and not later?

- Any constraints to operate under?

Step #2: Align on user personas

Each persona has its own set of pains, needs and wants. It’s very important to spend time discussing the various personas who can be using this product. For example, I see parents and children as broad user groups here. Without these user groups, three personas stand out for me: Parents with kids under 14, parents with teenage kids, and teenagers.

- Parents with kids usually accompany the kids for purchase so pain is not too big.

- Parents with teenage kids would want to jointly manage their money and also provide their teenage kids access to funds for some essential purchases like books, food etc.

- Teenagers on the other hand would want to climb the ropes of personal finance and be able to purchase basic supplies and necessities on their own.

If I had to pick one, I would pick the 2nd and the 3rd because they are under addressed and also create the most stickiness and also ensure the teenager is pulled into our banking ecosystem much sooner.

In general, some questions to discuss and seek answers to would be:

- Who are the user groups for this product?

- What are the various personas under each user group?

- What are the pains, needs and wants for each persona?

- Pick one or two personas to design the product for and explain why you picked them

Step #3: Define a solution to solve the persona's problem

Once the target persona(s) is picked and pain points or needs are discussed in detail, its important to identify the biggest ones to solve first with the MVP.

Lets say, the biggest pain for the teenager is to be able to independently use funds from the joint account for essential purchases and for parents to be able to view and authorize purchases made by their kids within the allocated budget for them each month. For MVP, I would define the product experience for the two personas as below:

Parents experience: Parents can use their existing personal accounts to create a joint account and add their kid to their joint account. They can allocate a fixed budget each month and select categories of purchases they want to allow (ex: food, books, amazon etc). Once approved, JioBank will issue a debit card for each member in the joint account. When kid makes a purchase then the parents are notified in the web app or through SMS (if subscribed) and can decline the purchase if they want to.

Teenagers experience: The teenager can view the budget allocated to them each month and categories/merchants they can spend across. They can view transactions made and balance left after each purchase completion in a web app.

Conclusion

Fintech is a very interesting niche within product management. If you are motivated to empowering entities to lead a better financial life, if you can deal with 2x stakeholders and rules with a smile and if you don’t shy away from getting into the weeds and learning the complex domain then this area of specialization is a great fit for you.

Read this next:

- How to land a PM job using RocketBlocks

- PM homework assignments

- Doing a product deep dive

- PM interview preparation plan

- Three key ways to prepare for PM interviews

- Interviewing PMs (interviewer perspective)

- Learning about the product org

- PM interview prep next steps

- PM interview prep plan

- Success metrics PM interview questions

- Favorite product PM interview answer

- Cracking PM behavioral interviews

P.S. Are you preparing for PM interviews?

Real interview questions. Sample answers from PM leaders at Google, Amazon and Facebook. Plus study sheets on key concepts.