How to read a Bain & Co. relative market share chart

|

|

|

Every consulting firm has their own unique twist they like to put on market analysis. For Bain & Co., one metric that they love to use is the concept of relative market share.

In this post, we'll do a deep dive on the concept and cover the following topics:

- What is relative market share (RMS)?

- How do I calculate relative market share (RMS)?

- Reading a relative market share chart

- Example RMS analysis video

What is relative market share (RMS)?

Relative market share is a metric that helps assess how a brand's position within the market relative to its peers. At a high level, it attempts to understand how scale (measured in relative market share) drives (or doesn't drive) profitability. While this concept has some similarities to BCG's growth share matrix, the key difference is that RMS is focused externally (e.g., how a company stacks up in a market versus its competitors), while the growth share matrix is internally focused (e.g., how does two business units at the same company compare).

You can do relative market share analysis at multiple different levels: brand, business unit or company. For example, you could focus on brand (e.g., Dove vs. the owning company Unilever) or at a company level (e.g., Facebook). The key part is to make sure that for any given analysis you're comparing apples to apples (e.g., brands to brands, companies to companies).

It's called *relative* because instead of simply looking at absolute sales volumes, relative market share indexes everyone's performance to the market leader. This is important because differ wildly: a 20% market share might be market leading in some markets and middling in others.

How do I calculate relative market share (RMS)?

Calculating relative market share is straight forward. It requires knowing two, simple equations.

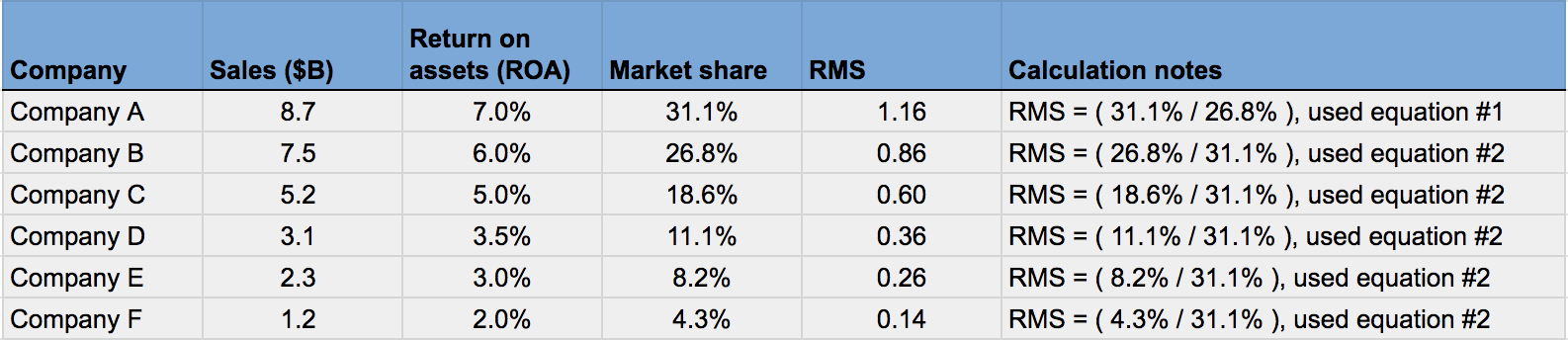

Equation #1: Calculating the market leader's RMS

Market leader RMS = Market leader's market share / Next biggest competitor's market share

Equation #2: Calculating everyone else's RMS

Everyone else's RMS = Company's market share / Market leader's market share

Example: calculating relative market share (RMS)

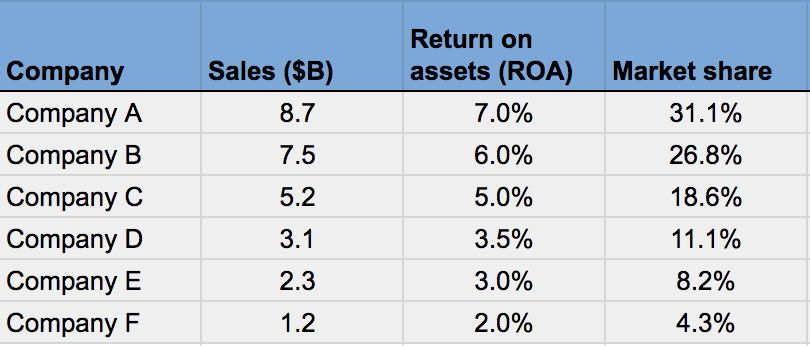

Imagine you have the following market, with six companies all competing with the same product lines:

Now, if you apply the relative market share equations, you'll arrive at the following RMS numbers for each of the six companies:

Got a Bain interview?

"I used RocketBlocks for 20 minutes each night during the recruiting process. Peers from MBB complimented my increased ease in math, which boosted my confidence and my ability to land offers with Bain, BCG, and McKinsey!" -- Lindsay Van Landeghem, Consultant at Bain & Co.

Reading a relative market share chart

Now that we've calculated RMS, let's think about how to display this information in a chart.

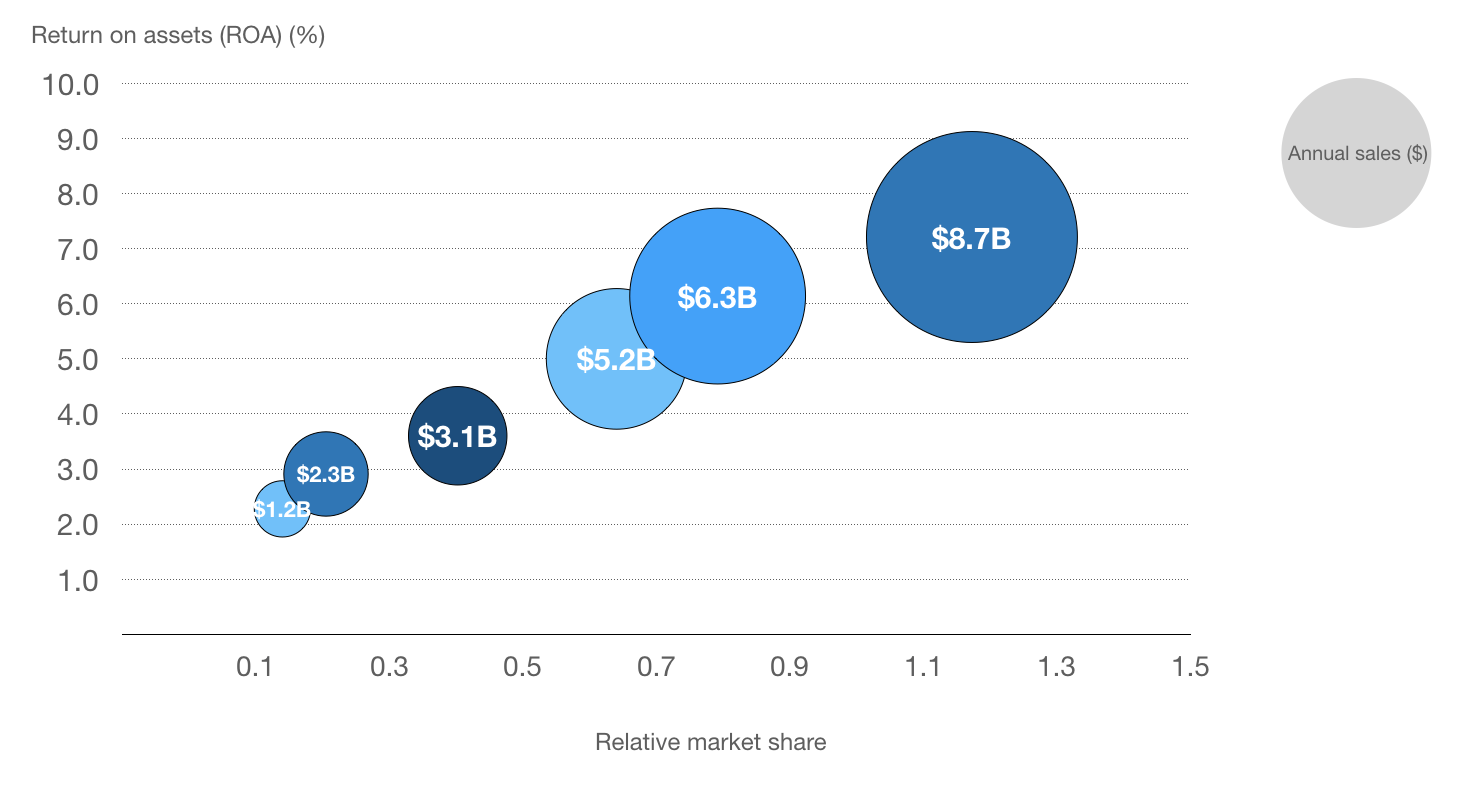

The typical format is to use a chart, with relative market share plotted on the x-axis, a profitability measure like return on assets (ROA) or profit margin on the y-axis and the size of each company represented by bubble that scales up or down with sales volume. Thus, continuing with our example above, we should product a relative market share chart that looks like this:

Key takeaways

- There is a strong, positive correlation between relative market share and profitability (as measured by ROA)

- Given the above, the data seems to indicate that scale is a likely driver of profitability in this industry (e.g., strong economies of scale)

- Thus, companies in this market should act accordingly and pursue strategies which can help them gain (or maintain) scale.

Many traditional manufacturing industries (e.g., textiles, etc.) exhibited market dynamics like the above.

Alternative example

As we noted above, the relationship between market share leadership and profitability isn't always perfectly correlated.

In fact, many studies have shown that while share leadership used to be a strong predictor of profitability leadership as well, that as business complexity has grown simply gaining economies of scale isn't the only way to turn a solid profit.

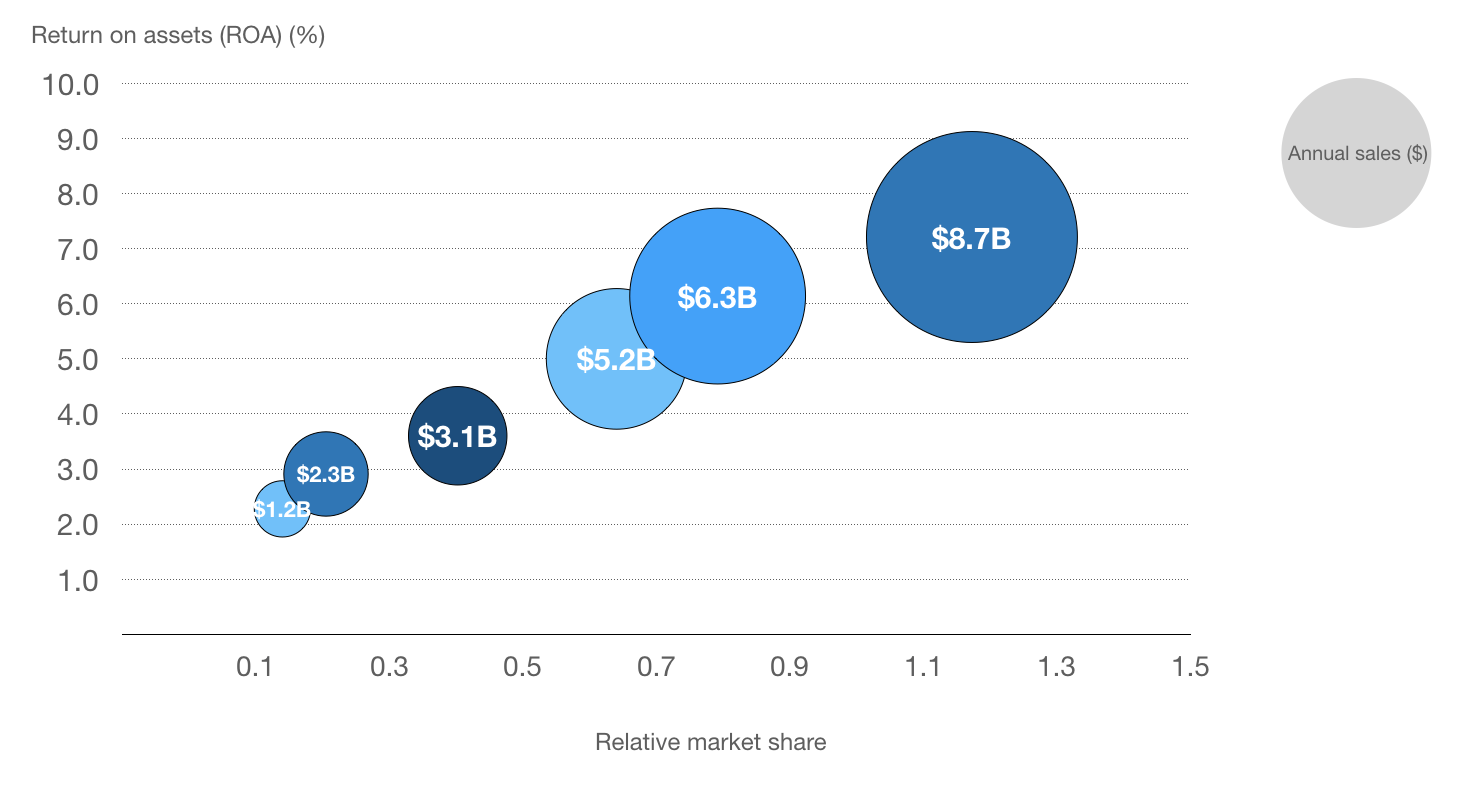

Due to that, it's likely that many modern markets might look more akin to this:

Key takeaways

- In this market, the strong, positive correlation between scale and profits breaks down - competitors on either side of the RMS scale can compete

- There is "sogginess" in the middle which potentially suggests that building a niche brand is feasible and building a mass market brand is feasible but being "neither here nor there" isn't a winning position

Modern consumer hardware is a good example of this type of market dynamic, where niche, higher end players like Apple are profitable as well as mass market, cheaper alternatives like Samsung, while competitors like Sony are stuck in the middle.

Video overview of reading a relative market share chart

Below, our Founder, Kenton Kivestu, provides an overview of the relative market share concept, complete with a description of how to calculate it and interpret the charts.

P.S. Are you preparing for consulting interviews?

Real interview drills. Sample answers from ex-McKinsey, BCG and Bain consultants. Plus technique overviews and premium 1-on-1 Expert coaching.