The Chinese Tech Scene - A Primer

An overview of key Chinese tech companies and developing themes in super apps, social commerce and offline-to-online.

|

|

|

Tencent | Bytedance | Meituan-Dingping | Baidu | Alibaba | Pinduoduo | Additional tidbits

The Chinese tech scene is amazing. And if you're planning on a career in tech, it's worth paying attention to because there is a lot to learn from it.

When I was growing up, the dominant narrative around Chinese tech was they steal IP and copy our best products. It wasn't innovation, it was “fast-following.” To be fair, there is definitely some truth to that (see here for a recent example). But to stubbornly hang on to that outdated narrative now is folly.

The Chinese tech scene is exploding and many of the companies, strategies and features are not only different from what we see in the US tech scene, they're entirely new, creative and exciting. Put simply, they're innovative.

"The future has arrived — it's just not evenly distributed yet." - William Gibson, Sci-Fi author

Simutaneous live-streaming on 40 accounts selling womens clothes. #Chinaecommerce pic.twitter.com/EMifFcCLLV

— 𝙈𝘼𝙏𝙏𝙃𝙀𝙒 𝘽𝙍𝙀𝙉𝙉𝘼𝙉 (@mbrennanchina) September 22, 2019

The goal of this post

There is no way to do the Chinese tech scene justice in a single blog post. Full stop.

So I'm not going to try. Instead, my intent here is to write a primer post that can serve as a reference guide for learning more - hence the copious links included below.

Organizationally, I've bucketed the post into companies, because it's the easiest way to wrap your head around things - even though most of the important trends overlap companies. For each company, I've provided a 2-3 paragraph overview and then cited a curated list of links to go deeper if you want (WARNING: There is probably a solid 48-hours of content linked from this post so if you're planning to consume it all, give yourself some time :).

Finally, there are three top level themes that emerge that are worth calling out: 1) super apps 2) social commerce and 3) online-to-offline (O2O). While there are many differences between the US and Chinese tech scene, I think it's particularly pronounced around these themes and I'll try to call these out below where applicable.

One caveat: there is no doubt a ton of innovation in Chinese hardware too (e.g., DJI, etc.) but this post is focused on software companies, and particularly consumer-oriented software companies.

Tencent (Top)

Let's start with Tencent - it's the T in BAT (Baidu, Alibaba, Tencent), which is the Chinese equivalent of FAANG.

While Tencent may not ring a bell, it's the parent company to a few brands you've likely heard of: WeChat, QQ, Tencent Music and a veritable array of gaming assets (e.g., Riot Games which makes League of Legends, Supercell which makes Clash of Clans).

WeChat, it's most popular product, is a Super App that essentially acts like a life operating system for everyday Chinese citizens. This is not something we see a lot of in the US - at least so far. Years ago, many of the US tech giants opted for an app “constellation” strategy vs. one mega-app to rule them all. Facebook is a prime example of the constellation strategy: FB main app, Instagram app, Whatsapp, Messenger, etc. vs. integrating them all together. Furthermore, while Facebook is a behemoth with lots of different products it's fairly well contained to social networking. WeChat is instrumental across many different aspects of modern life in China - from ordering food to chatting with relatives to buying a car. It is "the" trail-blazer in the Chinese trend of Super Apps (for more on Super Apps, see this helpful overview from Connie Chan, a GP at Andreesen Horowitz).

A driving force in WeChat's Super App approach is its mini-programs strategy - this is notably different then how many Western tech companies operate (they're not trying to build everything themselves). The way to think about a mini-program is like an app within an app. If you want food delivery, you open up WeChat and then find a food delivery service within it. Or if you want to buy a Tesla, you open the WeChat app and find the Tesla mini-program. Seriously, you can do both. WeChat is more akin to a virtual shopping mall than a chat app, and even that sells WeChat's capabilities short.

How big are mini-programs? Really big. To put into context, more people use WeChat mini-programs on any given day than open Twitter or Snapchat - combined (at least as of now in early 2021)! To get a sense of the full breadth of mini-programs, what the experience looks and feels like, and the top categories, I recommend this very good, 85-slide deep dive on mini-programs.

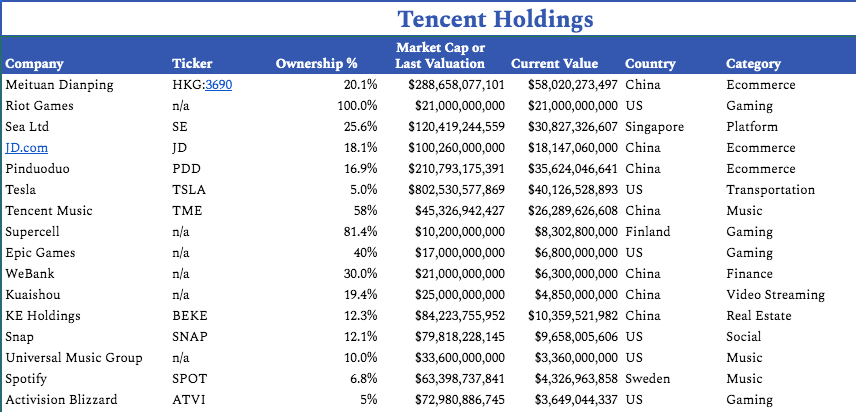

In addition to its homegrown products, Tencent might be the closest thing we have to an internet version of Berkshire Hathaway - a mega holding company with tons of investments. Writer Packy McCormick has done a great job cataloging many of these here (snapshot below).

Source: Packy McCormick, Not Boring

The company has made over 700+ investments but only about ~100 are public so far. To call out a few key ones, Tencent owns material stakes in Spotify, Tesla, Epic (maker of Fortnite), Snapchat, Universal music and many rising Chinese companies like PDD (below), Meituan (below), NIO.

To go deeper, this is a fantastic podcast on Tencent origin story, which talks about the early development of their first chat app, QQ, which was similar to the original AOL instant messenger.

Bytedance (Top)

Bytedance is the parent company of TikTok (well known in the US for addicting dance videos and for temporarily attracting the ire of the Trump admin) but also runs major apps such as Toutiao, a news feed app, and Douyin, a short-form video app just like TikTok.

@jasonderulo I got the same shirt in 9 different colors for this tik tok. Don’t let it flop. @megamediaent

♬ The Weeknd – Often (Kygo Remix) - Camille

If the defining story of WeChat is the Super App concept, then the defining concept of Bytedance is the algorithmic feed. While Western social media networks like Facebook, Twitter and Instagram have focused on building social feeds based off who we've connected with (e.g., friends or people we want to follow), Bytedance has perfected the art of building a curated feed based on what it thinks you want to see - from signals about what you've watched, what you liked, commented on, shared, etc. The closest American analogy to this type of feed is YouTube, which is more algorithmically driven, although it's not presented in traditional, vertical “feed” form. To learn more about the algorithmic feed, listen to this Ben Thompson podcast and go flip this through this interactive presentation on how the TikTok feed works.

Bytedance has been perfecting the algorithmic feed long before its TikTok acquisition. Toutiao, one of its other key franchises, is essentially an algorithmically driven news feed. So instead of seeing what your crazy uncle is reading (e.g., the Facebook experience), you log into Toutiao to see what the algorithm thinks you want to see (and what the Chinese govt is OK with you seeing). YC combinator's Anu Harihan describing the AI driven rise of Toutiao.

Source: Marketing to China

Given Bytedance's success with Toutiao and their ambitions to grow their business beyond China, it's not surprising they found TikTok's algorithmic video product compelling - it was Toutiao but for entertainment (not news). Before acquiring TikTok, they essentially cloned it with an app called Douyin, which grew like wild fire. You can find good details on Douyin's rise in China here. Despite Douyin's crazy growth in China, it didn't help further their ambitions of breaking into the Western markets so they acquired TikTok to help achieve that goal. TikTok now functions as the international version of Douyin, while the apps look and feel the same the user bases are completely segmented (e.g., a TikTok user won't see the most popular Douyin videos and users and vice versa).

To go deep into TikTok's backstory and evolution, I recommend this deep dive podcast from Acquired. It's also worth checking out this NYT interview with the TikTok Founder, Alex Zhu.

Meituan-Dingping (Top)

You've probably ordered food on Doordash, Postmates or Uber Eats. Imagine if you took all of those companies, rolled them into one mega food delivery service and then threw in Yelp, TripAdvisor and a travel booking service akin to Kayak to boot. If you did that, you'd have Meituan-Dingping, sort of - they are doing even more than that. In fact, Meituan's Founder, Wang Xing, talks about his vision to become the "Amazon of services".

Source: GGV Capital

Meituan-Dingping is taking the aforementioned Super App and super-charging with an Online-to-offline (O2O) focus. While roughly 50% of its revenue comes from food delivery, around 75% of its profit comes hotel, travel and in-store items. Essentially, they've used super high frequency consumer purchases which can help form app-usage habits (e.g., ordering food delivery) to drive user adoption and then tacked on a slew of additional, less-frequent but higher margin services like travel booking or beauty salon appointments to monetize their user base.

To emphasize the scale at which Meituan has successfully added on additional services, consider that they've booked over 2M+ hotels in a single day (and almost certainly way higher today given that stat comes from 12/31/2018). To put this into context, this would be like Airbnb saying they've added a food delivery business and done peak daily deliveries at the same scale Doordash does. For more sense of Meitaun's scale, there is some good data here. If you can book a haircut via Doordash or UberEats in the future, you'll likely have Meituan-Dingping to thank for laying out the playbook.

To go deeper, this GGV Capital piece provides a nice overview, including a timeline of key milestones (e.g., merger with Dingping), detailed charts on their revenue and profit breakdowns plus some nice videos showing Meituan-Dingping in use. TechInAsia has a good piece from a local analyst in China who spent some at HQ and tries to dispel 4 myths that people get wrong about Meituan.

Baidu (Top)

The simple way to understand Baidu is that it's China's Google.

It's core service is a search engine (like Google), it offers a popular mapping service (like Google) and it dabbles in a wide range of AI-fueled initiatives like self-driving cars (again, like Google). In a fun note of history, Google's co-founder, Larry Page, actually cited Robin Li, Baidu's co-founder, when filing his original US patents for PageRank (the algorithm that would power Google search), as Li had also done substantial work on indexing content via links.

Of the major Chinese tech companies, it maybe the least interesting in the "What's different?" context because it's the most similar to its American counterpart. Of course, there are differences but the core of both companies is a search engine and its monetization strategies are similar.

While it might be tough to see Amazon offering Taobao like services or Facebook replicating everything Tencent does with WeChat, Google actually succeeded in offering search services in China for a period of time (2006 to 2010), with relative success - about 33% of the market share. They exited after a murky incident involving hacking and IP theft and its involvement in China was always complicated due to Chinese censorship. MIT Technology Review has a great summary of this history.

Google hasn't reentered, although they had plans to which were scuttled, and Baidu essentially owns search in China the way Google does in most Western economies.

Alibaba (Top)

The easiest way to understand Alibaba is to think of it loosely as China's Amazon, with its own homegrown version AWS and of PayPal plus a bunch of other goodies too (e.g., did someone say machine learning powered cameras for pig farming? Yep, Alibaba does that too.).

Source: Synched AI & ML Review

Along with its BAT peers, Tencent and Baidu, it's one of the elder statesman of the Chinese tech giants. At a high level, the best way to think about Alibaba is to start with their three main e-commerce pillars:

- Alibaba.com, which is focused on B2B transactions. The best way to think of this is like an Amazon for Business (e.g., where a business goes to procure the products it needs).

- Tmall, which is a business-to-consumer e-commerce platform. This functions exactly like third-party merchants selling via Amazon (NOTE: Amazon generally downplays when you're buying from them vs. a 3P, but 3P merchants on Amazon is 50%+).

- Taobao, which is a consumer-to-consumer e-commerce platform. You can think of this as something like Ebay, Craigslist, Etsy or Facebook Marketplace, where a consumer or crafter is selling directly to another consumer.

On top of this, Alibaba also has it's Ant Financial group, valued at around $300B, as well as Aliyun, its cloud services offering. Aliyun is still smaller Western competitors like Microsoft Azure and AWS, but it's sizable doing roughly $10B in revenue annually in 2020 and growing at 60% YoY.

If you want to go deep on Alibaba's business and back story, I highly recommend this podcast from the Acquired guys. It's worth understanding more about Jack Ma, since he's got an inspirational story (e.g., growing up poor, struggling with math in school, to learning about the internet for the first time on a trip to America) and has inspired a whole generation of Chinese entrepreneurs. To get the full back story, I recommend this book: The house that Jack Ma built. For those who just want a quick glance, this great recording of an early speech he gave to employees demonstrates his intensity.

Pinduoduo (Top)

Pinduoduo is an insanely fast growing, social-shopping app founded by Colin Haung, a former Google software engineer and Microsoft engineering intern. Despite only starting in 2015, it runs the 2nd largest online marketplace in China (next to Alibaba), has become the poster child for social shopping and is valued at north of $200B.

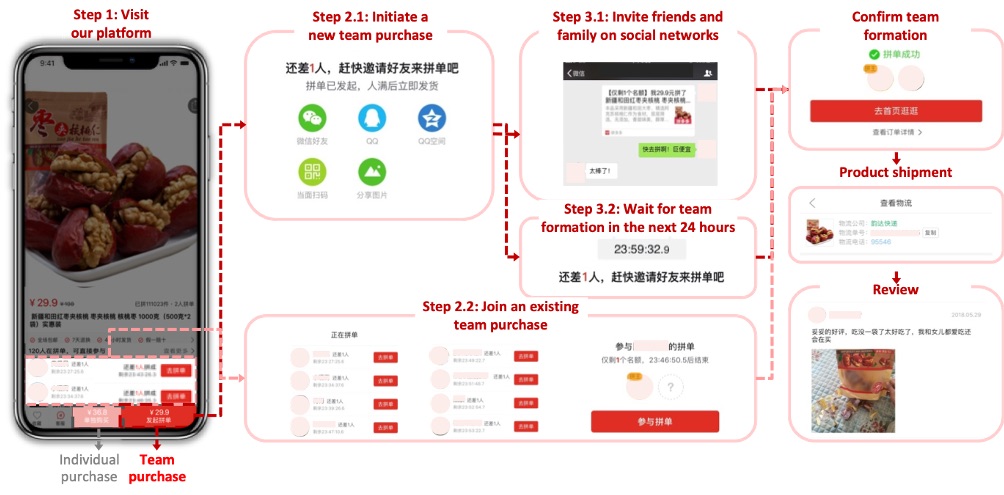

Notably, Pinduoduo's early growth was driven by a feature called “team buying,” which allowed groups of consumers to band together (e.g., I'll get 20 of my friends to each buy some toilet paper - yes, really!) and then the merchant will agree to give us a hefty discount for buying in bulk.

Source: Y Combinator

Additionally, Pinduoduo leans into the “fun” aspect of shopping, trying to gamify the experience and make it fun all around. They've launched popular features like Price chop, which let users get products for free (if they recruit enough friends to the platform) and Orchard mini-game which lets them raise a virtual fruit tree that they can “water” by visiting stores, shopping and taking other incentivized actions. If users take enough incentivized actions, the tree will bear fruit and Pinduoduo will ship the customer real fruit as a celebration of this milestone.

Recently, Pinduoduo has pushed the concept of “team buying” further down the stack with something they're calling consumer-to-manufacturer, C2M for short. The basic concept is that Pinduoduo will recruit manufacturers making desirable products (e.g., TVs for other major brands like Sony, etc.) and help them with marketing and demand generation to sell their products directly to consumers.

For more detail on this, there is an excellent write up by Anu and Nic at Y Combinator. It goes into detail on social e-commerce, team buying and a lot of the interesting innovations that led to the rise of PDD. And if you want to go even deeper, this 2hr+ podcast on the history of PDD is particularly good on the background of the founder Colin Huang and his original insights.

Additional tidbits (Top)

Finally, I want to call out a few additional tidbits and worthwhile sources of info on the Chinese tech scene.

Payments and logistics infrastructure

Why is so much social shopping & e-commerce innovation happening in China (e.g., Pinduoduo, Meituan, et al)? One answer is China's advantage in 1) payments infrastructure and 2) logistics infrastructure. Both are available more widely in a programmable, affordable fashion - the same way cloud computing is readily available via AWS, Azure, etc. in the US.

Bill Gurley, an uber-successful (pun intended) American VC from Benchmark, explains this in a great tweet storm here.

Tech in rural China

When you think about all the aforementioned companies and products, it's easy to picture gleaming sophisticated technology in futuristic cities like Shanghai and Shenzhen. But that's only part of the story.

There is a lot of interesting technology being applied at scale in rural China. For example, smart cameras monitoring thousands of chickens and using machine learning to identify ones which need the farmers attention - this is a real product that Alibaba provides today. Blockchain chicken farm (which has a crazy title and isn't particularly well written) does a good job highlighting this rural trend though.

Mobile UIs of Chinese apps

The look and feel of Chinese apps often feels significantly different - and not just due to the Chinese characters. Dan Grover, a PM at Facebook who formerly was based in China and worked for Tencent, has a few really nice blog posts which illustrate this. This overview on mobile UI patterns is great and this deeper dive on how Chinese companies handled Covid-19 news in their UIs is also an interesting read.

Good sources on all things tech in China

Matt Brennan, an analyst on China with pretty deep knowledge on the tech scene there, shares lots of great insights on Twitter.

Connie Chan, also referenced earlier in this post, is another great source of knowledge on Chinese tech. She's a general partner at A16Z and shares a lot of cross-border trends and learnings from China. Another good source is Lillian Li, an ex-management consultant from BCG, who works as a VC based in China (she also writes a paid subscription newsletter about tech in China).

TechinAsia is a good tech blog covering, you guessed it, the tech sector in Asia. Sort of like a TechCrunch.

Is there more?? 😱

Oh boy, yes, there is. But we'll save these for a future update. In the meantime, two other notable companies which aren't mentioned above.

Kuaishou is a newer, short-form video app that competes with Douyin and is growing like a week in China - it has an upcoming IPO.

Didi-Chuxing, the start-up that famously took on Uber in China and won, is the largest ride-hailing company in the world and has its sights set on international growth.

P.S. Are you preparing for PM interviews?

Real interview questions. Sample answers from PM leaders at Google, Amazon and Facebook. Plus study sheets on key concepts.